Navigating the Labyrinth of Tax Planning: A Guide to Financial Efficiency

In the intricate world of personal finance, where every dollar and cent holds the potential to shape one’s future, tax planning emerges as both a compass and a roadmap. As the seasons of life ebb and flow, so too do our fiscal responsibilities, urging a proactive approach to managing the nuances of taxation. Understanding tax planning is akin to mastering a complex dance; it requires awareness of the rhythm of tax laws and an appreciation for timing, strategy, and foresight. This article delves into the essential components of effective tax planning, offering insights that empower individuals and businesses alike to optimize their financial standing while navigating the often daunting landscape of tax obligations. Whether you seek to minimize liabilities, maximize deductions, or simply demystify the process, join us on this journey toward informed financial decision-making and ultimately, peace of mind.

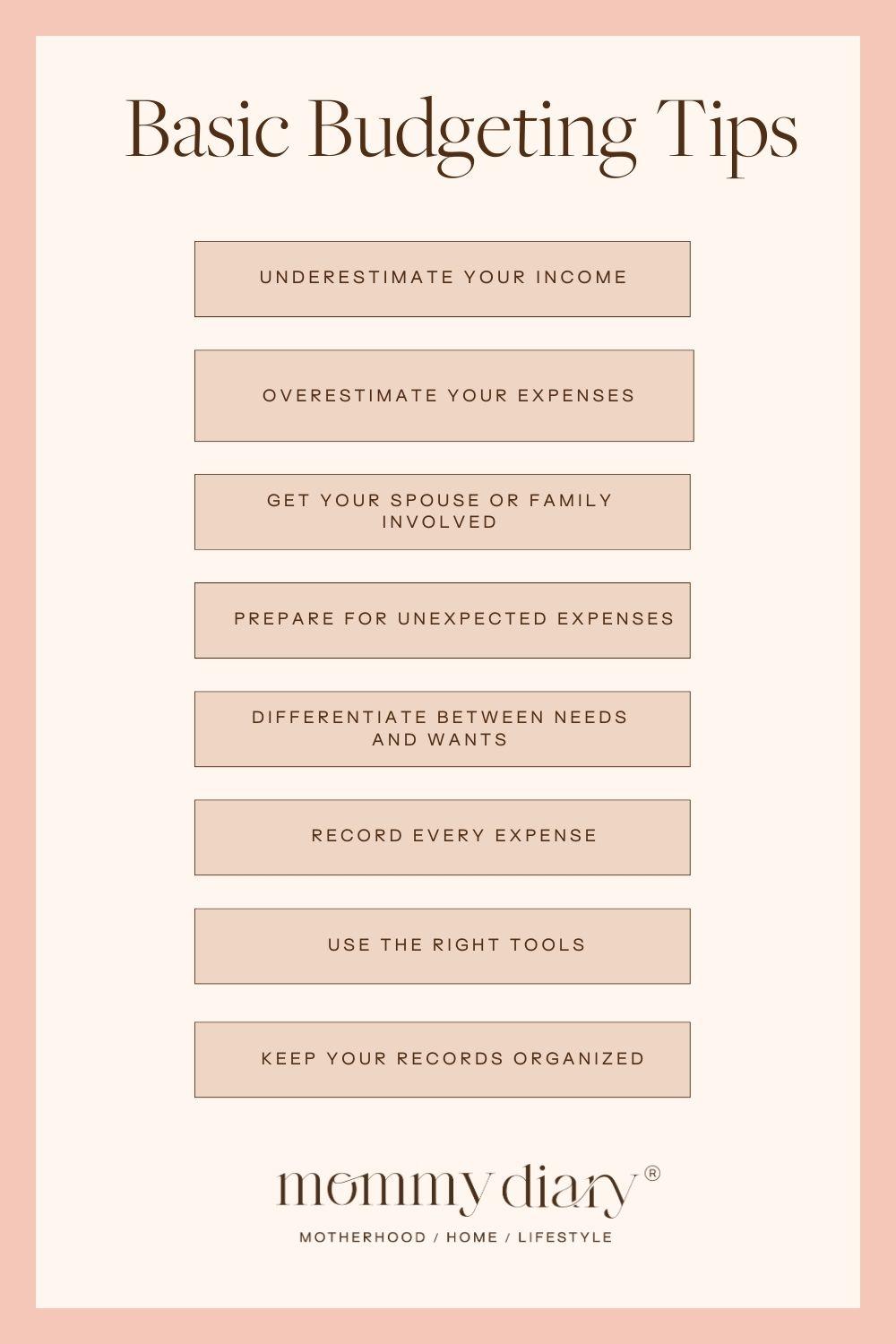

Budgeting Tips

Creating a comprehensive plan for your finances requires a careful approach to manage income and expenses. One effective strategy is to establish a monthly budget that tracks all sources of income alongside expenditures. This method not only highlights spending patterns but also identifies areas where you can cut costs. For instance, consider evaluating subscriptions and memberships; you might find that you’re paying for services you no longer use. Here are a few suggestions to streamline your spending:

- Set financial goals: Define short-term and long-term objectives.

- Track daily expenses: Keep a log of what you spend to see where your money goes.

- Use budgeting apps: Find tools that help automate your tracking process.

Tax planning is another critical aspect to include in your budgeting strategy, as it can substantially influence your net income. Being aware of potential deductions and credits can save you money and make room for future investments. Create a tax calendar to keep track of important deadlines and necessary documents, ensuring you’re always prepared for the tax season. Consider the following tips for effective tax planning:

| Tip | Description |

|---|---|

| Maximize deductions | Explore deductions relevant to your profession and personal expenses. |

| Contribute to retirement accounts | Take advantage of tax-deferred contributions to minimize taxable income. |

| Keep accurate records | Document all expenses meticulously to support your claims. |

Debt Management

When it comes to balancing your financial obligations, managing outstanding debts effectively is paramount to successful tax planning. Ensuring that you have a clear understanding of your debts can directly influence your ability to maximize deductions and minimize tax liabilities. Start by identifying and categorizing your debts, as this can help you prioritize payments. Maintain a list with details like creditor name, interest rate, and current balance. This will not only aid in your budgeting efforts but also provide insight into how interest payments can impact your taxable income.

In addition, consider tax deductions that may be available for certain types of debt. For instance, mortgage interest is often deductible, and student loan interest may also provide tax relief. Keeping thorough documentation of all your debt-related payments and any applicable interest will ensure that you can leverage these deductions. Here’s a simple table to categorize potential tax-deductible debts:

| Debt Type | Potential Tax Deductions |

|---|---|

| Mortgage | Interest payments |

| Student Loans | Interest payments |

| Investment Loans | Interest deductions (if applicable) |

Saving for Retirement

Saving for your golden years is more than just setting aside money; it’s an intricate dance with tax implications that can influence how much you end up with. Understanding tax-advantaged accounts can help you maximize your savings effectively. Options such as 401(k)s, IRAs, and Roth IRAs offer various tax benefits that can reduce your taxable income in the present or future, allowing your money to grow tax-free or tax-deferred. Here are some key points to consider:

- Employer Matching: Take full advantage of any employer match in a 401(k) – it’s free money!

- Tax Bracket Considerations: Use tax brackets to your advantage when deciding how much to contribute to traditional vs. Roth accounts.

- Withdrawal Rules: Be aware of when you can access your savings without penalties, which is crucial for effective tax planning.

To visualize the potential growth of your savings with different tax strategies, consider the following table comparing the growth of a $10,000 investment over 30 years at an average annual return of 7%:

| Account Type | After-Tax Value at Retirement | Tax Rate |

|---|---|---|

| Traditional 401(k) | $76,000 | 25% |

| Roth IRA | $100,000 | 0% on withdrawals |

As you can see, the type of retirement account you choose can significantly affect your overall savings. By understanding these nuances and strategizing effectively, you can enhance your financial security in retirement.

Emergency Fund Planning

Establishing a safety net for unforeseen circumstances is essential for anyone aiming for financial stability. An emergency fund acts as a buffer against unexpected expenses, such as medical emergencies or urgent home repairs, that can derail your financial plan. Generally, experts recommend setting aside at least three to six months’ worth of living expenses in your fund. This practice not only provides peace of mind but also enables you to manage your tax obligations without the added stress of financial strain.

To create a robust emergency fund, consider the following strategies:

- Set a savings goal: Determine how much you need based on your monthly expenditures.

- Automate your savings: Set up automatic transfers from your checking account to your emergency fund to ensure consistent contributions.

- Utilize high-yield savings accounts: Opt for accounts that offer better interest rates, allowing your savings to grow while remaining accessible.

| Expense Category | Monthly Estimate |

|---|---|

| Housing | $1,500 |

| Utilities | $300 |

| Groceries | $400 |

| Transportation | $250 |

Investment Strategies

Investing wisely requires an understanding of how taxes can impact your overall returns. One effective strategy is to take advantage of tax-advantaged accounts. These include individual retirement accounts (IRAs), health savings accounts (HSAs), and 401(k) plans. By directing your funds into these vehicles, you can potentially defer taxes or even avoid them altogether on the growth of your investments. Consider the benefits of each account type to optimize your investment strategy:

- IRAs: Tax-deferred growth until withdrawal, with potential tax-free withdrawals in retirement for Roth IRAs.

- HSAs: Triple tax advantage: contributions are tax-deductible, grow tax-free, and withdrawals for qualified medical expenses are tax-free.

- 401(k): Employer matching contributions, tax-deferral on earnings, and potential for lower taxable income in the years you contribute.

Another vital aspect to consider is tax-loss harvesting, which helps offset gains by selling investments at a loss. This technique can effectively reduce your tax burden and improve your net returns over time. Additionally, keeping track of long-term vs. short-term capital gains taxation is essential. Long-term investments, held for over a year, are typically taxed at a lower rate compared to short-term investments. Below is a comparison of capital gains tax rates that you might find useful:

| Holding Period | Capital Gains Tax Rate |

|---|---|

| Short-term (1 year or less) | Ordinary income tax rates (10% – 37%) |

| Long-term (more than 1 year) | 0%, 15%, or 20%, depending on income |

Stock Market Investing

When considering your approach to market investments, it’s crucial to integrate tax efficiency into your overall strategy. Optimizing your tax obligations can substantially impact your returns, allowing more of your gains to remain invested and compounding over time. Some key strategies include:

- Hold investments long-term: By holding assets for longer than a year, you may benefit from lower capital gains tax rates.

- Utilize tax-advantaged accounts: Contributing to accounts like IRAs or 401(k)s can help you defer taxes and grow your investments without immediate tax penalties.

- Harvest tax losses: Selling underperforming investments can offset gains in other areas, reducing taxable income.

Understanding the way that different types of income are taxed is equally essential. Here’s a simplified overview that illustrates various income types in relation to tax implications:

| Type of Income | Tax Rate |

|---|---|

| Short-Term Capital Gains | Ordinary Income Rate |

| Long-Term Capital Gains | 0%, 15%, or 20% (depending on income) |

| Dividends (Qualified) | 0%, 15%, or 20% (depending on income) |

| Dividends (Ordinary) | Ordinary Income Rate |

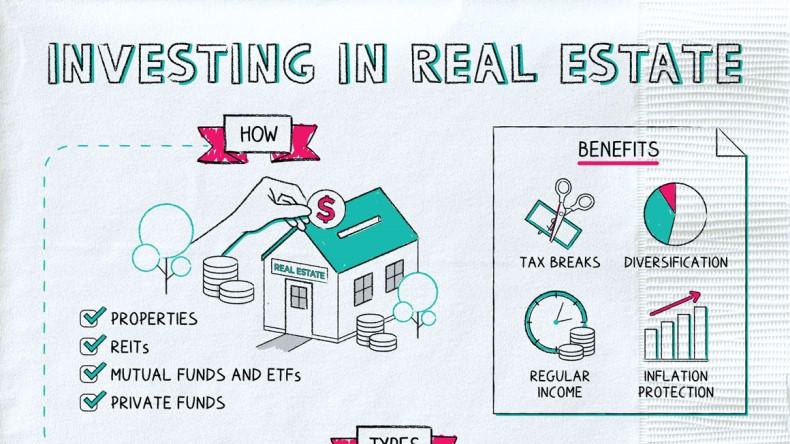

Real Estate Investment

In the realm of , tax planning serves as a vital component that can significantly affect your financial returns. Implementing savvy tax strategies allows you to maximize your profits while minimizing potential liabilities. Consider the following approaches:

- Depreciation Benefits: Utilize property depreciation to offset taxable income, making investments more lucrative.

- 1031 Exchanges: Facilitate tax-deferred exchanges to reinvest profits without immediate tax penalties.

- Utilizing Deductions: Take advantage of property-related deductions, such as mortgage interest, property tax, and repair costs.

Moreover, understanding different tax structures based on your investment strategy can provide added advantages. Here’s a quick comparison of common scenarios:

| Investment Type | Taxation Method | Potential Benefits |

|---|---|---|

| Residential Rental | Ordinary Income | Stable cash flow, depreciation, and write-offs. |

| Commercial Property | Ordinary Income | Greater deductions, potential for higher appreciation. |

| REITs | Dividends | Liquidity and consistent income distributions. |

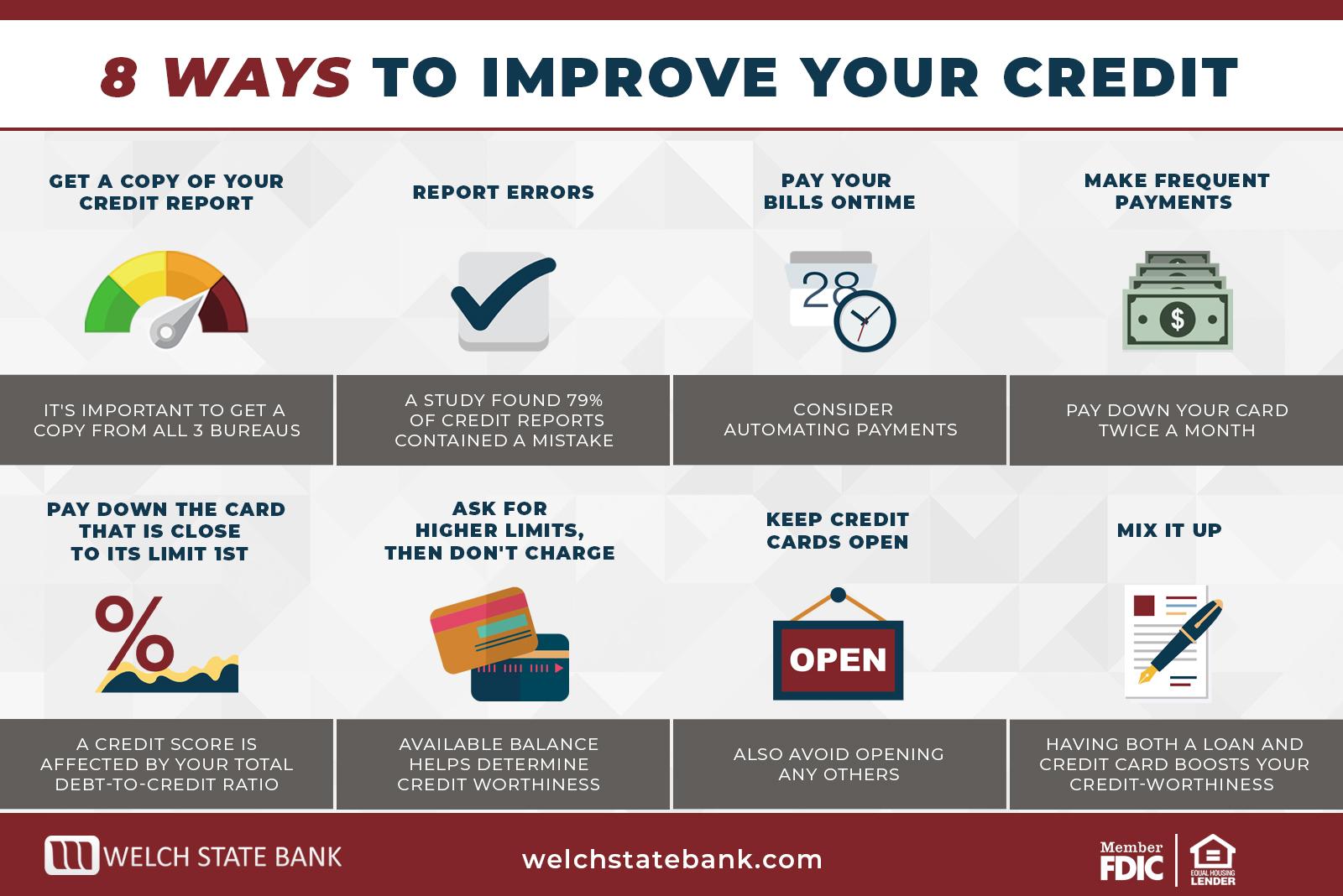

Credit Score Improvement

Improving your credit score requires a strategic approach, and one of the most effective methods is through meticulous tax planning. By ensuring that your tax obligations are met on time, you not only avoid penalties that could negatively impact your credit standing but also demonstrate financial responsibility to lenders. Here are some key tactics to enhance your credit profile:

- Pay Taxes on Time: Consistently meeting your tax deadlines helps maintain a positive credit history.

- Utilize Tax Deductions: Take advantage of all eligible deductions to reduce your taxable income and keep your finances in better shape.

- Consider Tax-Advantaged Accounts: Contributions to IRAs or HSAs can provide saving benefits while potentially improving your credit utilization ratio.

Additionally, it’s wise to regularly review your tax documents for errors that could lead to audits or discrepancies. An accurate filing presents you as a financially responsible individual, which can positively affect your creditworthiness. The following table summarizes essential credit score factors related to tax planning:

| Factor | Impact on Credit Score |

|---|---|

| Payment History | 35% – On-time payments boost your score. |

| Credit Utilization | 30% – Lowering debts improves this ratio. |

| Length of Credit History | 15% – Maintaining accounts over time helps. |

| Types of Credit | 10% – A diverse portfolio is favorable. |

| New Credit Inquiries | 10% – Multiple inquiries can lower your score. |

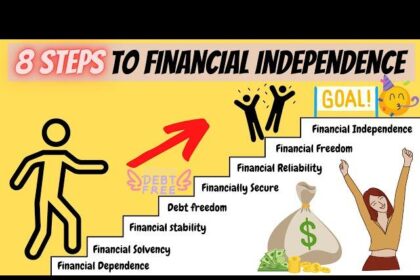

Financial Independence

Achieving requires a robust approach to managing your taxes effectively. The essence of tax planning lies in understanding how to legally minimize your liabilities while maximizing potential investments. By establishing a comprehensive strategy, you can redirect your tax savings into avenues that compound wealth over time. Consider the following strategies:

- Maximizing Retirement Contributions: Utilize tax-advantaged accounts such as IRAs and 401(k)s.

- Tax-Loss Harvesting: Offset capital gains with losses to reduce taxable income.

- Utilizing Deductions: Keep abreast of potential deductions, from mortgage interest to medical expenses.

Another key component is understanding the different tax classification of income—ordinary versus capital gains. This distinction can influence how you structure your investments. For instance, capital gains are often taxed at lower rates than ordinary income, making it advantageous to focus on long-term investments. Below is a simple comparison of tax rates that can guide your decisions:

| Income Type | Typical Tax Rate |

|---|---|

| Ordinary Income | 10%-37% |

| Short-Term Capital Gains | Equivalent to Ordinary Income |

| Long-Term Capital Gains | 0%-20% |

Passive Income Streams

In the quest for greater financial stability, many individuals are exploring multiple avenues for generating income without the need for constant active involvement. Among these avenues are various methods that can yield consistent returns over time. Real estate investments, Dividend stocks, and peer-to-peer lending are just a few examples of how can significantly bolster your financial portfolio. By leveraging these income-generating assets, you can enjoy a more relaxed financial lifestyle while potentially reducing your taxable income through strategic planning.

When it comes to managing these streams, understanding the tax implications is essential. For instance, the tax treatment of dividends, rental income, and interest from peer-to-peer platforms can vary widely. Here’s a brief comparison to illustrate some key points:

| Income Type | Tax Rate | Deductible Expenses |

|---|---|---|

| Rental Income | Ordinary Income Tax Rates | Mortgage Interest, Repairs, Property Tax |

| Dividend Income | Qualified (0%, 15%, or 20% based on income) | None |

| P2P Lending Interest | Ordinary Income Tax Rates | Potential Loss Deductions |

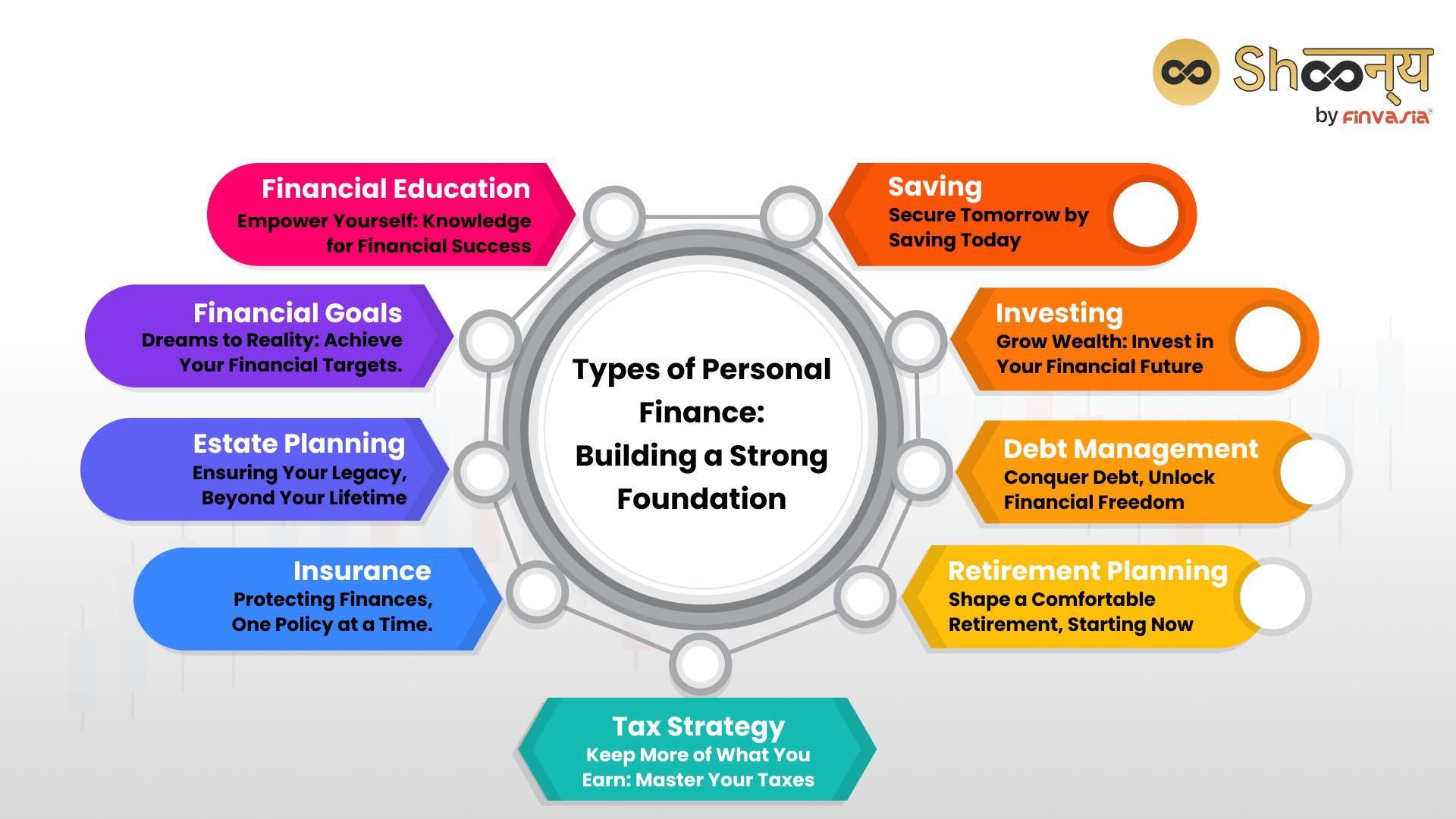

Tax Planning

Effective financial management requires a strategic approach to ensure that one’s tax obligations are minimized while remaining compliant with the law. involves evaluating your financial situation and making informed decisions that will impact your taxes throughout the year. By utilizing deductions, credits, and other tax incentives, individuals and businesses can maximize their savings. Key strategies include:

- Timing Income and Expenses: Shifting income to future years or deferring expenses can significantly influence taxable income.

- Utilizing Retirement Accounts: Contributions to tax-advantaged accounts such as IRAs and 401(k)s help reduce taxable income while preparing for the future.

- Understanding Deductions and Credits: Familiarizing oneself with available tax deductions and credits can ensure that no opportunities for savings are overlooked.

Incorporating these strategies requires careful planning, especially considering the ever-changing tax laws. To illustrate potential savings, the table below outlines common deductions that taxpayers may qualify for:

| Deductions | Eligibility Criteria | Potential Savings |

|---|---|---|

| Mortgage Interest | Homeowners with a mortgage | Varies by loan amount |

| Student Loan Interest | If you’ve paid interest on a qualified student loan | Up to $2,500 |

| Medical Expenses | Exceeding 7.5% of Adjusted Gross Income | Varies based on AGI |

Retirement Accounts (IRA, 401k)

When it comes to long-term financial security, understanding the intricacies of different retirement accounts is paramount. Both Individual Retirement Accounts (IRAs) and 401(k)s offer unique tax advantages that can help maximize your savings in the long run. For example, IRAs often allow for tax-deferred growth, meaning that contributions can be made with pre-tax income, reducing your taxable income for the year. On the other hand, a 401(k) typically allows for higher contribution limits and may come with employer matching contributions, effectively boosting your retirement savings. Here are some key features to consider:

- IRA: Contribution limits, eligibility based on income, and potential tax deductions.

- 401(k): Higher contribution limits, employer match options, and potential loans against the balance.

When planning your tax strategy, it’s essential to assess how these accounts align with your financial goals. Factors such as your current tax rate and your expected rate at retirement can greatly influence your decision on which account to prioritize. For example, pre-tax contributions to these accounts reduce your taxable income now, while Roth IRAs feature after-tax contributions, allowing for tax-free withdrawals in retirement. Understanding these dynamics can lead to effective tax planning that not only accumulates wealth but also ensures minimal tax liability as you transition into retirement.

| Account Type | Tax Treatment | Contribution Limit (2023) |

|---|---|---|

| Traditional IRA | Tax-deferred | $6,500 (or $7,500 if age 50+) |

| Roth IRA | Tax-free growth | $6,500 (or $7,500 if age 50+) |

| 401(k) | Tax-deferred | $22,500 (or $30,000 if age 50+) |

Financial Planning for Families

Understanding the intricate world of taxation is essential for families looking to secure their financial future. Effective tax planning can unveil opportunities that not only reduce taxable income but also enhance savings. Families should consider a few key strategies to streamline their tax situation:

- Utilize Tax-Advantaged Accounts: Contribute to accounts such as 401(k)s or IRAs to benefit from tax deductions.

- Maximize Deductions: Keep detailed records to itemize deductions adequately, such as mortgage interest and medical expenses.

- Claim Eligible Credits: Research available tax credits, like the Child Tax Credit, which can significantly lower tax liability.

Moreover, keeping abreast of changes in tax legislation can provide families with the edge they need. The following simple table outlines different tax brackets applicable to families, helping with budget planning for the year ahead:

| Income Range | Tax Rate |

|---|---|

| $0 – $10,000 | 10% |

| $10,001 – $40,000 | 12% |

| $40,001 – $85,000 | 22% |

| $85,001 – $160,000 | 24% |

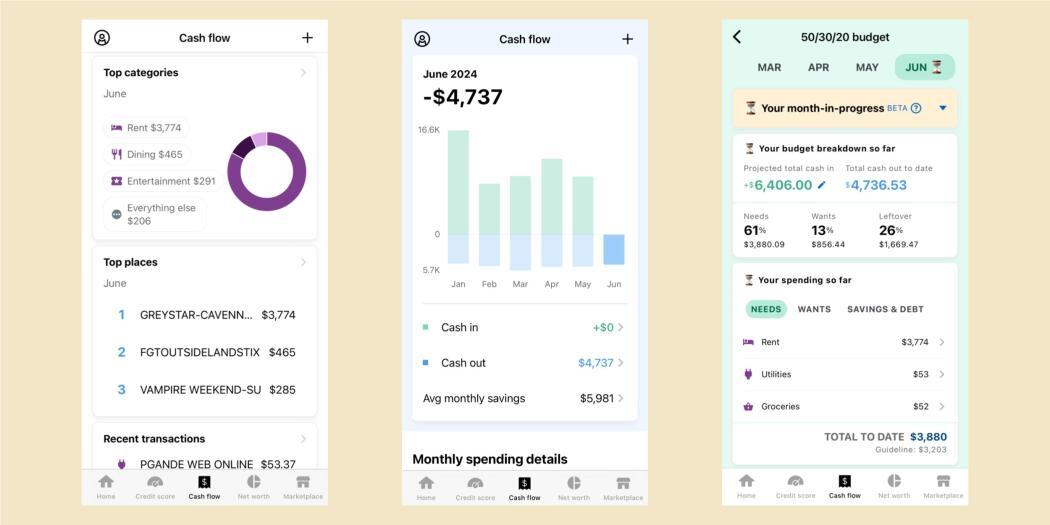

Personal Finance Apps

As fiscal challenges evolve, leveraging technology has become essential for effective management of personal finances, especially when it comes to tax preparation and planning. provide a convenient platform to streamline record-keeping, manage expenses, and ensure compliance with tax obligations. These applications typically offer features such as:

- Expense Tracking: Monitor daily transactions, categorize expenses, and gain insights into spending habits.

- Budgeting Tools: Create and manage budgets tailored to your financial goals and monitor progress over time.

- Receipt Scanning: Digitally store and organize receipts, making it easier to substantiate deductions during tax season.

- Tax Estimators: Calculate estimated tax liabilities throughout the year to avoid surprises during tax filing.

To further enhance usability, many include forecasting capabilities that help users anticipate future tax obligations based on current income and expenses. This functionality can be especially beneficial when planning any significant financial decisions. Here’s a brief comparison of popular apps:

| App Name | Key Feature | Cost |

|---|---|---|

| Mint | Comprehensive budgeting and expense tracking | Free |

| You Need A Budget (YNAB) | Goal-oriented budgeting with proactive planning | $11.99/month |

| TurboTax | Tax filing and optimization of deductions | Varies |

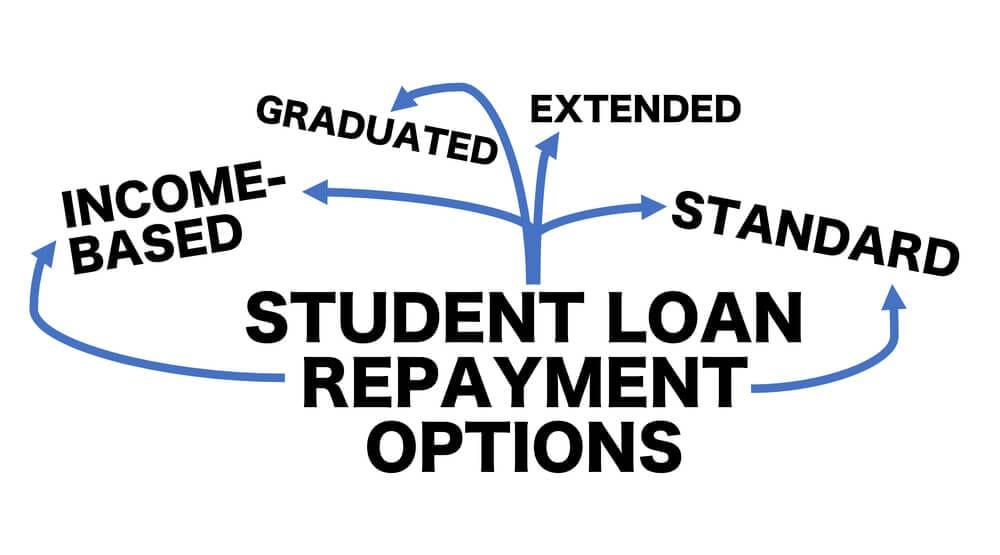

Student Loan Repayment

Managing your financial landscape effectively includes a keen eye on your loan repayment strategy. With student loans being a significant aspect of many young adults’ finances, understanding the options available can lead to potential savings and smoother financial transitions. Here are some key considerations when planning your repayment:

- Income-driven repayment plans: These plans adjust your monthly payment based on your income and family size, potentially lowering your payment significantly.

- Loan forgiveness programs: Check if you qualify for federal loan forgiveness, particularly through public service or teaching credentials.

- Refinancing: Look into refinancing options if you have good credit. This can reduce your interest rate and total repayment amount.

Furthermore, it’s crucial to align your repayment choices with your tax planning efforts. For instance, if you are paying interest on your student loans, you may be eligible to deduct this amount from your taxable income, provided you meet certain criteria set by the IRS. However, it’s advisable to keep track of all relevant documentation and understand the deduction limits. Here’s a simple overview:

| Deduction Type | Max Deduction Amount |

|---|---|

| Student Loan Interest Deduction | $2,500 |

| Income Phase-out Start | $70,000 |

| Income Phase-out End | $85,000 |

Debt-Free Journey

Tax planning can be a powerful tool in your quest for financial independence. By strategically organizing your finances with the intent of minimizing tax liabilities, you can free up additional resources that can be redirected toward paying off debt. Here are several effective strategies to consider:

- Analyze your income sources: Different income streams are taxed differently; understanding this can help you make informed decisions.

- Utilize tax-advantaged accounts: Contributions to retirement accounts or health savings accounts can lower your taxable income.

- Keep track of deductions: Familiarize yourself with potential deductions that can lower your tax burden, such as mortgage interest, student loan interest, or medical expenses.

- Consider your filing status: Choose the most beneficial filing status based on your personal situation, as it can affect your overall tax rate.

To illustrate the potential benefits of effective tax planning, consider the following simple breakdown of tax savings derived from various strategies:

| Strategy | Potential Savings |

|---|---|

| Maximizing 401(k) contributions | $3,000 – $10,000 |

| Claiming eligible deductions | $1,500 – $5,000 |

| Utilizing an HSA | $1,000 – $3,600 |

By incorporating these strategies into your overall plan, you can ensure your hard-earned money is working effectively toward achieving the freedom that comes with being debt-free.

Credit Card Management

Effective management of credit cards is a cornerstone of successful tax planning, as it can greatly impact your financial landscape. By strategically utilizing your credit cards, you can build a positive credit history, ensuring you qualify for better loan rates down the line. Here are some tips to enhance your :

- Pay on time: Avoid late fees and interest charges by setting up reminders or automatic payments.

- Monitor usage: Regularly check your spending habits to stay within your budget.

- Utilize rewards: Maximize rewards programs and cashback offerings that align with your tax-deductible expenses.

Furthermore, maintaining a low credit utilization rate is pivotal in optimizing your credit score. Aim to keep the balance below 30% of your total credit limit. Here’s a quick visual to illustrate how credit utilization affects your score:

| Credit Utilization Rate | Estimated Credit Score Impact |

|---|---|

| 0-10% | Excellent |

| 11-30% | Good |

| 31-50% | Fair |

| 51% and above | Poor |

Budgeting for Freelancers

Managing your finances effectively is crucial for freelancers, particularly when it comes to budgeting for taxes. Unlike traditional employment, freelancers face variable income streams, which can make it challenging to anticipate how much they should set aside for tax obligations. A strategic approach to budgeting not only helps in avoiding last-minute scrambles but also ensures that you’re compliant with tax regulations. Here are some key points to consider:

- Estimate Your Tax Rate: Analyze previous years’ earnings to project your current tax liabilities.

- Separate Accounts: Maintain separate bank accounts for personal and business finances to simplify tax tracking.

- Set Aside Funds: Aim to save a percentage of each payment for taxes, ideally around 25-30%.

- Utilize Tools: Use budgeting apps or software designed for freelancers to categorize and monitor expenses.

Creating a budget specifically for tax planning can significantly relieve stress during tax season. A good practice is to maintain a simple overview of income and expenses. Below is a template that can guide your budgeting process throughout the year:

| Month | Estimated Income | Set Aside for Taxes (25%) |

|---|---|---|

| January | $2,500 | $625 |

| February | $3,000 | $750 |

| March | $2,800 | $700 |

| April | $3,500 | $875 |

Frugal Living Tips

Tax planning doesn’t have to be an overwhelming task filled with complex jargon. Instead, it can be a strategic opportunity to save money and simplify your finances. To get started, consider evaluating your current financial situation. Gather all necessary documents, including income statements, expense reports, and previous tax returns. This will build a clear picture of your financial health. Once you have this information, you can identify potential deductions and credits that apply to you, which can significantly lower your taxable income.

Another effective strategy is to explore tax-efficient investment options. You might consider utilizing tax-advantaged accounts such as IRAs or Health Savings Accounts (HSAs). By investing in these vehicles, you not only defer taxes but can also potentially reduce the overall tax burden on your earnings. Additionally, be sure to keep track of any capital gains or losses, as they can play a crucial role in your liability. Review the table below for a quick comparison of different tax-advantaged accounts:

| Account Type | Tax Benefits | Contribution Limit 2023 |

|---|---|---|

| Traditional IRA | Tax-deferred growth | $6,500 |

| Roth IRA | Tax-free withdrawals | $6,500 |

| Health Savings Account (HSA) | Triple tax advantage | $3,850 (individual) |

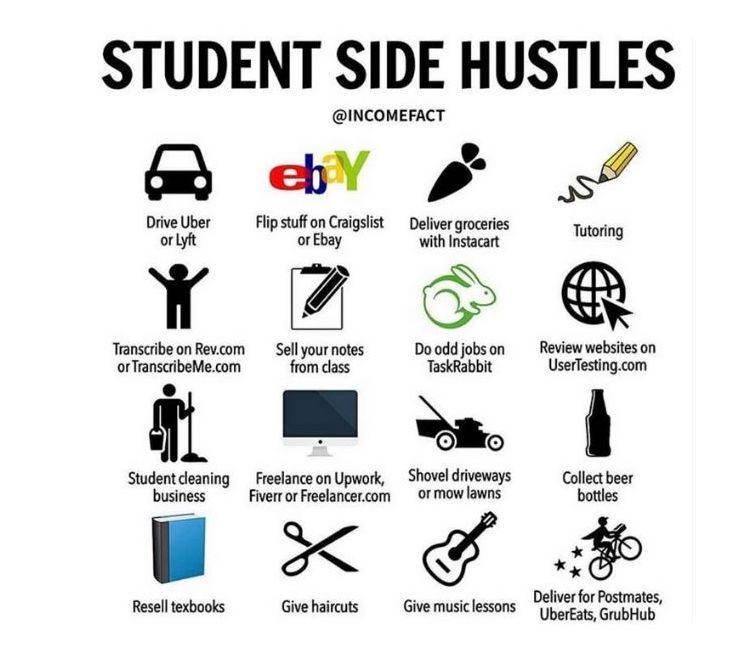

Side Hustles for Extra Income

Engaging in a side hustle can significantly bolster your income, but it also brings along the responsibility of effective tax planning. Understanding the tax implications of your additional earnings is crucial to avoid surprises come tax season. Many side hustlers overlook that any income, regardless of its source, must be reported. To streamline your financial strategy, consider keeping meticulous records of your earnings and expenses. Use tools like spreadsheets or apps to track every transaction. This not only simplifies filing but may also help you identify various deductions available to you.

Here are key points to remember for tax planning with your side hustle:

- Separate your finances: Maintain a distinct bank account for your side hustle to simplify tracking.

- Understand deductible expenses: Costs like supplies, marketing, and home office expenses can often reduce your taxable income.

- Estimate your taxes: Consider making quarterly estimated tax payments to avoid penalties and manage your cash flow effectively.

- Consult a tax professional: If your side hustle grows, professional advice can assist in navigating complex tax situations.

| Expense Type | Potential Deduction |

|---|---|

| Supplies | 100% of costs incurred |

| Home Office | Proportional to space used |

| Marketing Costs | 100% of advertising expenses |

| Travel Expenses | Deductible mileage or actual expenses |

Financial Literacy Education

Tax planning is an essential component of financial literacy, empowering individuals to make informed decisions that can lead to significant savings. Understanding the nuances of your tax obligations can help you maximize your deductions and minimize your liabilities. Here are some important factors to consider:

- Filing Status: Choose the correct filing status to optimize your tax benefits.

- Deductions vs. Credits: Know the difference; deductions lower taxable income, while credits reduce tax owed.

- Retirement Accounts: Utilize tax-advantaged accounts like IRAs and 401(k)s to reduce taxable income.

- Estimated Taxes: If you’re self-employed or have additional income, make sure to plan for estimated tax payments.

Moreover, effective tax planning involves anticipating future financial changes and making proactive adjustments. For instance, life events such as marriage, home purchase, or having children can significantly impact your tax situation. Consider the following strategies to stay ahead:

| Strategy | Benefit |

|---|---|

| Contribute to HSAs | Tax-deductible contributions that can be used for medical expenses. |

| Harvest Tax Losses | Offset gains with losses to minimize taxable income. |

| Keep Good Records | Efficient tracking of expenses can ensure you don’t miss valuable deductions. |

Insurance Planning

Effective management of your insurance portfolio plays a crucial role in a well-rounded financial strategy, particularly when it comes to optimizing tax liabilities. By strategically aligning your insurance policies with your overall financial goals, you can enhance your tax efficiency. It’s essential to understand various policy types, such as whole life, term life, and disability insurance, and how they can impact your tax situation. Consider how the cash values of life insurance can grow tax-deferred, providing a unique opportunity for wealth accumulation alongside protection.

Moreover, including health-related insurances within your planning can yield significant tax deductions. Policies like Health Savings Accounts (HSAs) not only offer insurance benefits but also contribute remarkable tax advantages by allowing contributions to grow and be withdrawn tax-free for qualified medical expenses. To illustrate the intersection of insurance types and potential tax benefits, consider the following table:

| Insurance Type | Tax Benefit |

|---|---|

| Whole Life Insurance | Cash value growth is tax-deferred |

| Term Life Insurance | Payouts are typically tax-free to beneficiaries |

| Health Savings Account (HSA) | Tax-free withdrawals for medical expenses |

Long-Term Wealth Building

Building lasting wealth requires a strategic approach to financial management, and tax planning plays a pivotal role in this journey. By understanding and utilizing various tax strategies, individuals can maximize the wealth-building potential of their income and investments. Some effective strategies include:

- Utilizing Tax-Advantaged Accounts: Contributing to retirement accounts, HSAs, and other tax-sheltered options allows individuals to grow their wealth while minimizing tax liabilities.

- Taking Advantage of Deductions and Credits: Familiarizing oneself with eligible tax deductions and credits can significantly reduce tax burdens.

- Investing in Tax-Efficient Funds: Selecting mutual funds or ETFs with lower turnover rates can help minimize capital gains taxes.

Moreover, proactive and mindful tax planning can prevent common pitfalls that erode wealth over time. An effective approach includes setting goals, regularly reviewing tax situations, and seeking professional advice when necessary. Consider these essential tips:

| Tip | Description |

|---|---|

| Plan Ahead | Project your income and expenses to anticipate tax implications before the year ends. |

| Keep Organized Records | Maintain meticulous records of income, expenses, and relevant documents for easier tax filing. |

| Stay Informed | Keep abreast of tax law changes that could affect your financial situation and planning strategies. |

Saving for College

When considering the costs associated with higher education, starting early with a well-structured financial plan can yield significant benefits. Setting aside funds for college expenses not only helps you avoid student debt, but taking advantage of tax-efficient savings options can also maximize your investment. Some popular methods include:

- 529 College Savings Plans – These tax-advantaged accounts allow your savings to grow tax-free when used for qualified education expenses.

- Coverdell Education Savings Accounts (ESA) – While contributions are limited, the earnings can be withdrawn tax-free for educational purposes.

- Roth IRAs – Though mainly for retirement savings, these accounts can be tapped for educational expenses without penalties under certain conditions.

In addition to savings strategies, it’s important to be aware of tax credits and deductions that can further support your financial goals. For instance, the American Opportunity Credit and the Lifetime Learning Credit both provide potential tax benefits for eligible expenses. The table below summarizes these credits:

| Credit | Max Amount | Eligibility |

|---|---|---|

| American Opportunity Credit | $2,500 per student | First four years of higher education |

| Lifetime Learning Credit | $2,000 per tax return | Available for all years of post-secondary education |

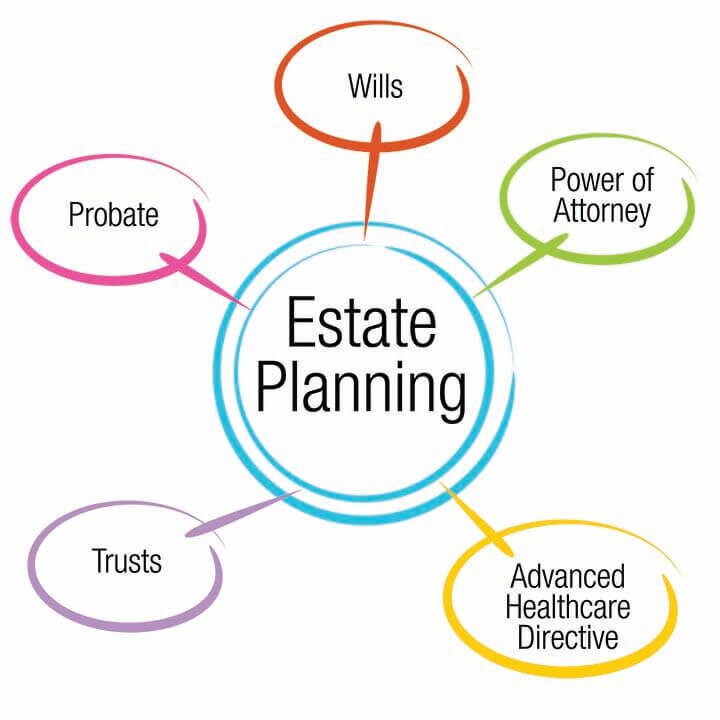

Estate Planning

Effective planning for the disposition of your assets is essential to ensure that they are preserved according to your wishes. Emphasizing the importance of understanding various tax implications can significantly impact your estate’s value. This requires careful consideration of the following key elements:

- Gift Taxes: Know the annual exclusion limits and how gifts can help reduce your taxable estate.

- Estate Taxes: Assess the potential estate tax thresholds and how they may affect your beneficiaries.

- Trusts: Explore the benefits of setting up trusts to manage and distribute assets efficiently.

Moreover, keeping abreast of changes in tax laws is vital, as legislation can change frequently. A proactive approach might include consulting with a tax advisor to formulate a cohesive strategy. Consider a comparison of potential estate reduction tactics:

| Strategy | Benefits | Considerations |

|---|---|---|

| Living Trust | Helps avoid probate | Initial setup costs |

| Charitable Donations | Reduces estate taxes | Potential loss of assets |

| Life Insurance | Liquidity for heirs | Premium costs |

Financial Goals Setting

When embarking on the journey of taxation, it’s essential to articulate specific financial objectives that align with your broader fiscal strategies. Consider these vital components for effective goal setting:

- Budgeting for Taxes: Allocate a portion of your income to cover anticipated tax liabilities.

- Investment Planning: Identify tax-efficient investment vehicles that align with your short and long-term goals.

- Retirement Contributions: Max out contributions to tax-advantaged retirement accounts like 401(k)s and IRAs.

- Emergency Fund: Build a reserve fund to cover unexpected tax liabilities or sudden changes in income.

Setting clear milestones helps in tracking your progress throughout the financial year. Utilizing tools such as tax calculators can aid in anticipating your financial position. A simple overview table might include:

| Goal | Target Amount | Due Date |

|---|---|---|

| Tax Savings | $5,000 | April 15 |

| Retirement Savings | $18,000 | December 31 |

| Emergency Fund | $3,000 | Ongoing |

Money Management for Couples

Tax planning is a vital aspect of financial harmony for couples, as it helps to maximize savings and minimize liabilities. By collaborating on your tax strategy, both partners can contribute to a clearer understanding of financial commitments and opportunities. Here are some key points to consider:

- Joint vs. Separate Filings: Determine whether filing jointly or separately will benefit you most. Joint filings often lead to lower tax rates and bigger deductions, while separate filings may be advantageous for unique financial situations.

- Maximize Deductions: Identify potential deductions that can be taken advantage of, such as mortgage interest or education expenses. This can yield significant tax benefits.

- Retirement Accounts: Discuss contributing to tax-advantaged accounts like IRAs or 401(k)s, as these not only reduce taxable income but also secure your future.

- Health Savings Accounts (HSAs): If you’re eligible, HSAs can provide a triple tax advantage by allowing tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

Creating a tax plan should also involve active communication about your financial goals and changes in circumstances. Consider meeting with a tax advisor to discuss your options; they can offer personalized insights based on your unique financial landscape. Here’s a straightforward comparison table to keep you focused on the essentials:

| Tax Strategy | Advantages | Things to Watch For |

|---|---|---|

| Filing Jointly | Lower tax rate, bigger deductions | Potential phase-out of benefits |

| Filing Separately | Protection from liability on partner’s taxes | Higher tax rates, fewer deductions |

| Max Deductions | Increased refund potential | Requires thorough documentation |

| Retirement Contributions | Tax deferral on growth | Contribution limits and penalties |

Family Budgeting

When it comes to managing household finances, strategic planning can make a world of difference. A well-structured fiscal approach not only aids in effective tax management but also ensures that your family’s financial goals are met. To start, consider these key components of a successful family budget that intertwines with tax planning:

- Income Tracking: Document all sources of income to understand your financial landscape.

- Expense Management: Categorize your regular expenses to identify potential savings.

- Emergency Fund: Allocate funds for unexpected expenses, minimizing financial strain during tax season.

- Investment Contributions: Prioritize tax-advantaged accounts, such as IRAs or 529 plans, to optimize savings.

Setting clear financial priorities empowers your family to navigate both day-to-day expenses and annual tax obligations smoothly. A well-organized budget should not only reflect current needs but also anticipate future challenges. Here’s a simple overview of how your budget can facilitate tax planning:

| Budget Category | Tax Strategy |

|---|---|

| Retirement Savings | Maximize contributions to reduce taxable income. |

| Health Expenses | Utilize HSAs for tax-free medical savings. |

| Educational Funds | Invest in 529s for tax-free growth towards education. |

Smart Spending Habits

Creating effective financial strategies involves harnessing the power of , especially during tax season. By understanding your income, deductions, and potential credits, you can make informed decisions that extend beyond April 15th. This means diving deep into your financial landscape to identify opportunities for optimizing your expenses throughout the year. Consider incorporating the following practices to ensure you’re maximizing your tax savings:

- Track Expenses Carefully: Maintaining a detailed record of your expenditures can help you locate deductibles you may have overlooked.

- Utilize Tax-Advantaged Accounts: Contributing to retirement plans or HSA accounts can lower your taxable income significantly.

- Reevaluate Investment Strategies: Identifying investments that yield favorable tax treatments can also be smart; consider long-term vs. short-term gains.

It’s crucial to strategize your spending in alignment with your long-term financial goals. Analyzing how your purchasing habits affect your tax situation can lead to better fiscal wellness. Building a robust budget prioritizes essential expenses and sets you on a path to identify possible tax shelters. Here’s a simple overview of budget categories that can enhance your tax strategy:

| Category | Tax Benefit |

|---|---|

| Medical Expenses | Deductions for out-of-pocket healthcare costs |

| Home Office | Potential deduction on business expenses |

| Education Costs | Eligible credits for tuition fees |

Personal Finance for Millennials

Understanding the nuances of tax planning can provide Millennials with significant financial advantages. By taking the time to educate yourself on various tax strategies, you can maximize your savings and minimize your liabilities. Here are some essential tax planning strategies that could serve you well:

- Contribute to Retirement Accounts: Utilize tax-advantaged accounts like 401(k)s and IRAs to lower your taxable income.

- Explore Tax Deductions: Keep track of eligible expenses such as student loan interest or education-related expenses that can reduce your tax burden.

- Stay Informed on Tax Credits: Look for credits such as the Earned Income Tax Credit (EITC) or the Lifetime Learning Credit, which can provide substantial savings.

- Plan for Major Life Changes: Be proactive about how events like marriage, having children, or buying a home impact your tax situation.

Additionally, employing a proactive tax strategy can not only help you save now but can also set you up for greater financial stability in the long term. Consider creating a simple tax checklist to ensure you’re not missing out on any opportunities:

| Action Item | Details |

|---|---|

| Review Income Sources | Identify all sources of income to ensure accurate reporting. |

| Document Expenses | Keep track of receipts and invoices for potential deductions. |

| Consult a Professional | If in doubt, seek advice from a tax professional for personalized guidance. |

Wealth Preservation Strategies

Effective tax planning is a crucial component of maintaining and growing your wealth. By understanding the intricacies of tax laws and utilizing various strategies, individuals can significantly reduce their taxable income and retain more of their hard-earned money. Key methods include optimizing deductions, maximizing tax-efficient investment vehicles, and carefully timing income and expenses. Each of these strategies can help safeguard your assets while enhancing your overall financial well-being.

Consider these essential tactics for maximizing tax efficiency:

- Retirement Accounts: Utilize accounts like IRAs and 401(k)s, which offer tax-deferred growth.

- Tax-Loss Harvesting: Offset capital gains with losses from other investments.

- Charitable Contributions: Support causes you care about while receiving tax deductions.

- Tax Credits: Explore available credits that directly reduce your tax bill.

Evaluate how these elements fit into your overall financial strategy. Here’s a concise comparison of tax-deferral vs. tax-exempt options:

| Strategy | Tax-Deferral | Tax-Exempt |

|---|---|---|

| Example Accounts | 401(k), Traditional IRA | Roth IRA, Municipal Bonds |

| Taxation Timing | Taxed at withdrawal | No tax on earnings |

| Income Limits | No limits | Income limits apply |

Insights and Conclusions

effective tax planning serves as a cornerstone of sound financial management, offering not only the opportunity to minimize liabilities but also the chance to align your fiscal strategies with your long-term goals. By understanding your unique financial landscape and leveraging the array of tools and resources available, you can navigate the complexities of taxation with confidence and clarity. Remember, tax planning is not merely a seasonal chore but an ongoing process that empowers you to make informed decisions throughout the year. As you embark on this journey, consider seeking professional guidance to tailor a strategy that best suits your needs, ensuring your financial future is bright and well-protected. After all, in the intricate tapestry of personal finance, a stitch of foresight today can lead to a wealth of advantages tomorrow.