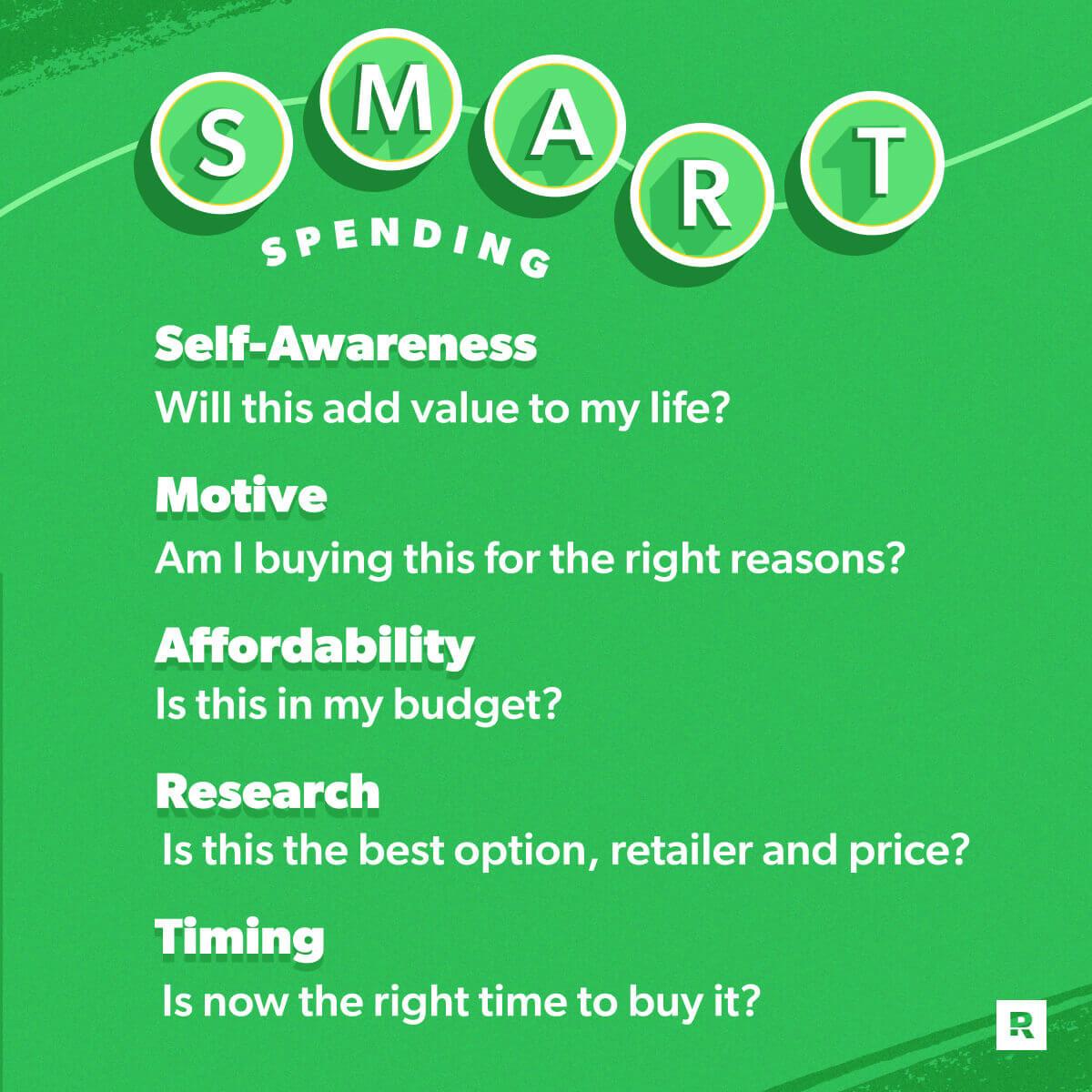

In a world where consumerism reigns supreme and financial stability often feels elusive, the need for smart spending habits has never been more crucial. As we navigate through a maze of enticing advertisements and fleeting trends, the art of spending wisely can seem like a daunting challenge. Yet, it is precisely this challenge that holds the key to not only achieving financial wellbeing but also empowering us to make choices aligned with our values. In this article, we embark on a journey to explore the principles of smart spending, unveiling practical strategies that can transform our approach to finances. By embracing these habits, we can cultivate a mindful relationship with money, allowing us to savor life’s offerings while securing a more stable future. Join us as we delve into the nuances of conscious consumption, the impact of informed decision-making, and the rewards that come from prioritizing what truly matters.

Budgeting Tips

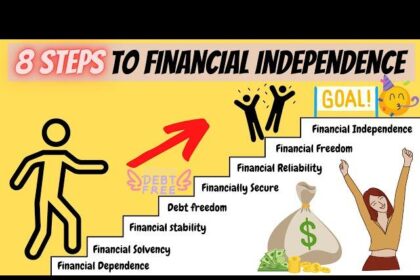

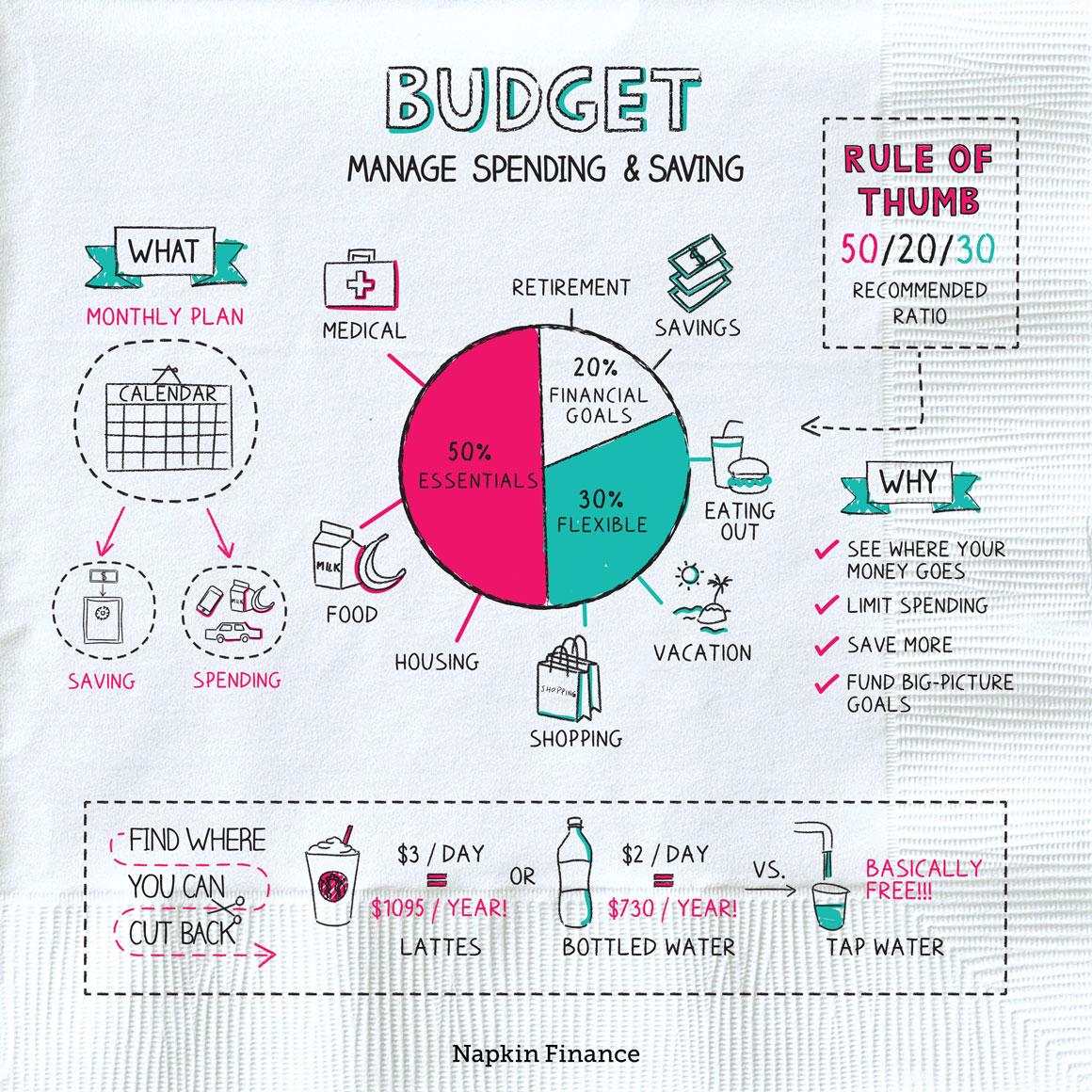

Creating a budget is just the start; the real challenge lies in adhering to it effectively. One way to enhance your discipline in spending is by adopting the 50/30/20 rule. This simple guideline suggests allocating 50% of your income to needs (like rent and groceries), 30% to wants (like dining out and entertainment), and 20% to savings and debt repayment. Keep track of your expenses by using mobile apps, which can provide insights into your spending habits and reveal areas where you might be overspending. Remember, it’s essential to regularly review and adjust your budget to reflect changes in your financial situation or lifestyle.

Additionally, consider implementing these smart spending techniques to maximize your savings:

- Set clear financial goals: Define short-term and long-term objectives.

- Use cash for discretionary spending: It’s harder to part with cash than swiping a card.

- Be mindful of impulse purchases: Employ the 24-hour rule; wait a day before buying.

- Compare prices: Use apps to find the best deals before making purchases.

| Category | Percentage of Budget | Suggested Amount (for $3000 Income) |

|---|---|---|

| Needs | 50% | $1500 |

| Wants | 30% | $900 |

| Savings/Debt Repayment | 20% | $600 |

Debt Management

Managing your debt effectively is crucial to achieving financial stability. Adopting smart spending habits can significantly reduce your reliance on credit and help you regain control over your financial life. Start by assessing your current debt situation, understanding interest rates, and prioritizing payments to tackle high-interest debts first. Additionally, consider implementing a monthly budget that allows you to allocate funds towards debt repayment while ensuring essential expenses are covered. To create this budget:

- Calculate your total income: Include all sources of income to have a complete picture.

- List your expenses: Track both fixed (rent, utilities) and variable expenses (groceries, entertainment).

- Identify discretionary spending: Find areas where you can cut back to free up funds for debt repayment.

Moreover, consider adopting the snowball or avalanche method for debt repayment. The snowball method focuses on paying off the smallest debts first to build momentum and motivation, while the avalanche method aims to minimize the interest paid by targeting the highest-interest debts first. Below is a simple comparison of these two strategies:

| Method | Approach | Best For |

|---|---|---|

| Snowball | Smallest debt paid off first | Building motivation |

| Avalanche | Highest interest paid off first | Minimizing total interest |

Saving for Retirement

When it comes to planning for the future, establishing a solid financial foundation is essential. By adopting smart spending habits, you can free up funds to allocate towards your retirement savings. Consider starting with the following strategies:

- Create a Budget: Track your income and expenses monthly to identify areas where you can cut back.

- Prioritize Needs Over Wants: Distinguish between essential purchases and discretionary spending to help allocate more funds toward retirement accounts.

- Limit Impulse Purchases: Use a waiting period before buying non-essential items to evaluate whether the purchase is truly necessary.

Another effective approach is to automate your savings. Setting up automatic transfers from your checking to your retirement accounts can lead to significant growth over time. Here’s a simple breakdown of how small daily changes can lead to substantial retirement contributions:

| Daily Savings | Annual Contribution | Estimated Growth (20 years) |

|---|---|---|

| $5 | $1,825 | $90,000 |

| $10 | $3,650 | $180,000 |

| $15 | $5,475 | $270,000 |

Emergency Fund Planning

Planning for the unexpected is a cornerstone of sound financial management. An emergency fund acts as a financial safety net, ensuring that sudden expenses like medical emergencies, car repairs, or unexpected job loss don’t derail your financial goals. To build a robust emergency fund, consider adopting a structured saving approach. Start by setting aside a portion of each paycheck, no matter how small, into a dedicated savings account. Automating your savings can make this process seamless, allowing you to prioritize your financial stability effortlessly.

Your aim should be to gather three to six months’ worth of living expenses in your fund, but it all begins with concrete goals. Here are some steps to set your plan in motion:

- Assess Your Expenses: Calculate your monthly living costs to determine your target fund size.

- Create a Monthly Savings Goal: Divide your target by the number of months you want to achieve it.

- Monitor & Adjust: Review your progress regularly and adjust savings rates as necessary.

| Monthly Expenses | Target Emergency Fund |

|---|---|

| $2,000 | $6,000 – $12,000 |

| $3,000 | $9,000 – $18,000 |

| $4,000 | $12,000 – $24,000 |

Investment Strategies

Creating a robust investment strategy doesn’t solely rely on market conditions; it also hinges on your spending habits. By focusing on smart spending, you can free up resources that can be redirected toward investment opportunities. Consider the following approaches to managing expenses effectively:

- Prioritize Needs Over Wants: Assess your expenses and distinguish between essential needs and non-essential wants.

- Set a Budget: Utilize budgeting tools to keep your spending in check and ensure you allocate a portion of your income toward investments.

- Shop Wisely: Look for discounts, use cashback apps, and choose quality over quantity to minimize unnecessary spending.

Another key element of a successful investment strategy is understanding the potential of your spending decisions. Each dollar you save can become a building block for your future investments. Here’s a simple comparison of saving vs. investing timeframes:

| Action | Timeframe for Rewards |

|---|---|

| Save $100/month | Short-term gains |

| Invest $100/month | Long-term growth potential |

Incorporating these strategies into your daily routine not only bolsters your financial health but also positions you for taking advantage of favorable investment opportunities when they arise.

Stock Market Investing

Investing in the stock market requires not just financial resources but also a mindset grounded in strategic planning and smart spending. One can maximize investment potential by reassessing how funds are allocated. Here are some effective strategies to cultivate wise spending habits:

- Budgeting Wisely: Implement a detailed budget plan that clearly separates your essential expenses from discretionary spending.

- Emergency Fund: Always set aside a portion of your income for unexpected expenses; this creates a safety net, enabling you to invest without fear of financial instability.

- Prioritize Needs Over Wants: Focus on essential purchases that contribute to your financial goals instead of impulsive buying that drains resources.

Moreover, understanding the psychological aspects of spending can enhance your investment strategy. It’s crucial to recognize the difference between savvy purchases that enable wealth accumulation and frivolous spending that undermines it. Consider the following mindset shifts:

- Value Assessment: Evaluate the long-term benefit of purchases rather than their immediate gratification.

- Investment Mindset: View each spending decision as an opportunity; ponder how it aligns with your financial objectives.

- Smart Research: Keep informed about market trends to make purchasing decisions that support your investment goals.

Real Estate Investment

Making wise financial choices in real estate can set the foundation for future wealth. To navigate this complex landscape effectively, consider these smart spending habits that can lead to fruitful investments:

- Research and Analyze: Before making a purchase, dig deep into market trends, property values, and neighborhood demographics. Knowledge is your best investment.

- Leverage Financing Options: Explore various financing avenues, such as traditional mortgages, hard money loans, or partnerships, to find the best fit for your situation.

- Budget with Precision: Maintain a clear budget that accounts for unforeseen expenses and regular maintenance, ensuring you avoid overspending.

Another key strategy is to focus on long-term value rather than immediate gratification. This method can enhance your overall investment portfolio:

- Choose Properties Wisely: Look for properties in areas with potential growth and stability, as these are more likely to appreciate over time.

- Prioritize Cash Flow: Consider multi-family units or properties with rental potential that can provide ongoing income to offset costs.

- Regularly Reassess: Periodically evaluate your investments to determine if adjustments are needed based on performance or market shifts.

| Investment Type | Pros | Cons |

|---|---|---|

| Single-Family Homes | High demand, easier to finance | Less cash flow potential |

| Multi-Family Units | Steady rental income | Higher management complexity |

| Commercial Properties | Long-term leases typically | More capital required upfront |

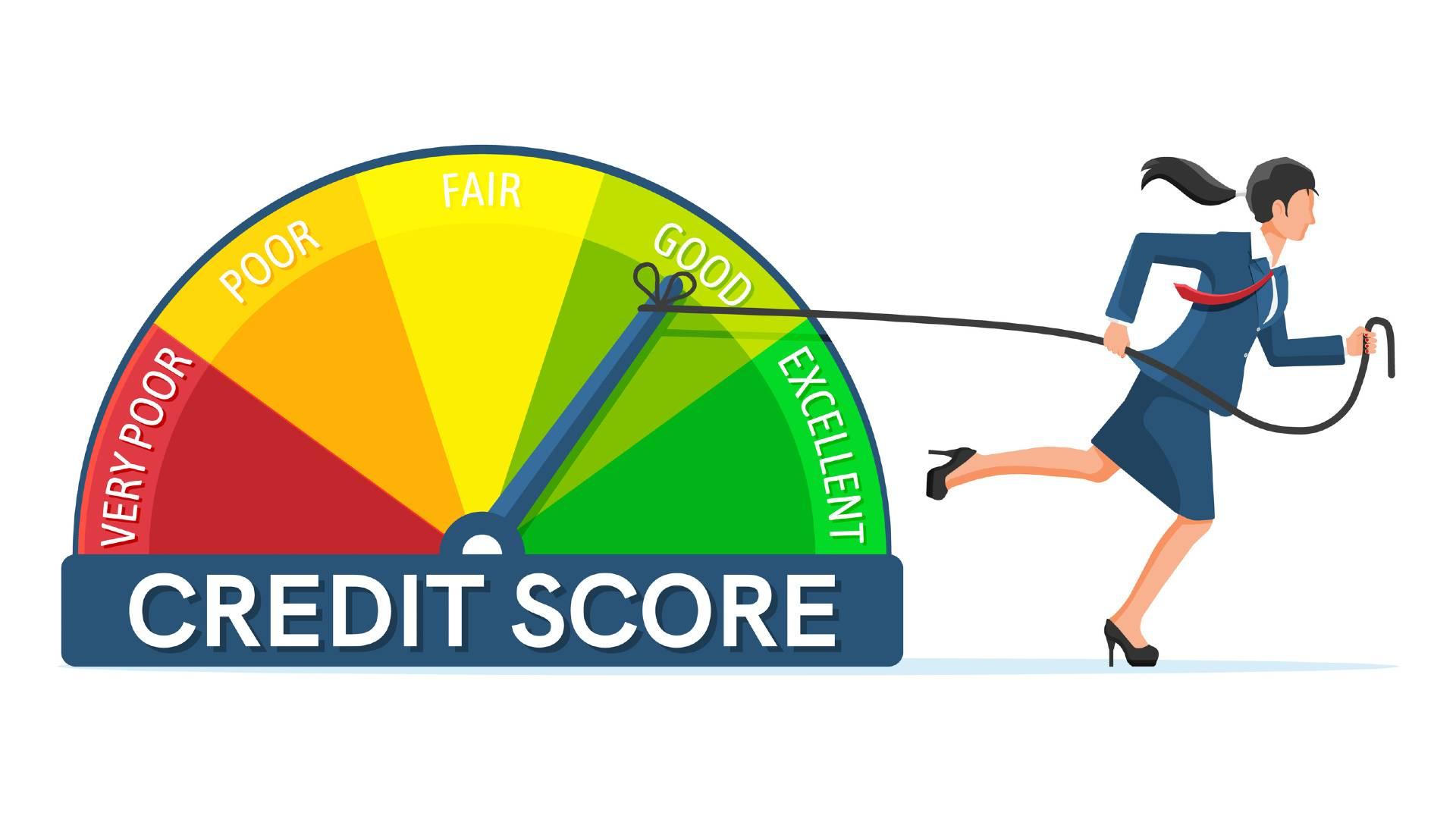

Credit Score Improvement

Enhancing your credit score is crucial in today’s financial landscape, and it often begins with mastering your spending habits. By adopting a more thoughtful approach to your finances, you can directly influence your credit utilization ratio, which is a significant factor in credit scoring. Here are some strategies to cultivate better spending habits:

- Create a budget: Establish a monthly budget that outlines your income and expenditures.

- Prioritize needs over wants: Focus on essential purchases and limit discretionary spending.

- Track your expenses: Utilize apps or spreadsheets to regularly monitor your financial activity.

- Consider cash-only spending: This can help prevent overspending and keep you within your budget.

Moreover, regularly reviewing your credit report is essential to understand your credit health better. Identify any areas for improvement, such as high credit utilization or missed payments. Taking time to rectify these can lead to significant boosts in your score. Here’s a simple way to compare your spending habits:

| Spending Activity | Impact on Credit Score |

|---|---|

| Paying bills on time | Positive |

| Maxing out credit cards | Negative |

| Maintaining low balances | Positive |

| Frequent credit inquiries | Negative |

Financial Independence

Achieving control over your finances often starts with mastering the art of savvy spending. This means being conscious of where your money goes, making informed choices, and prioritizing your needs over wants. Here are several smart habits to consider:

- Establish a budget: Create a detailed budget that includes all your income and expenses. This will help you identify areas where you can cut back and allocate more towards savings.

- Embrace minimalism: Focus on purchasing high-quality items that truly add value to your life rather than succumbing to trends or impulse buys.

- Utilize discounts: Take advantage of loyalty programs, coupons, and sales. This can significantly reduce your overall spending without sacrificing quality.

- Track your spending: Regularly review your expenditures to ensure that they align with your financial goals. Various apps can aid in monitoring and managing your finances effectively.

Another key aspect of achieving lies in making significant lifestyle changes. For instance, consider looking for cheaper alternatives that provide similar benefits. Here is a simple comparison table to illustrate this approach:

| Expense Category | Traditional Option | Alternative Option | Potential Savings |

|---|---|---|---|

| Cable Subscription | $100/month | $30/month streaming service | $840/year |

| Gym Membership | $60/month | Outdoor workouts | $720/year |

| Takeout Meals | $200/month | Home-cooked meals | $2,040/year |

Passive Income Streams

Building a wealth of can significantly transform your financial landscape, providing a safety net that supports your lifestyle regardless of your job status. There are a myriad of avenues to explore, each requiring different levels of investment, effort, and risk. Some options to consider include:

- Dividend Stocks: Invest in companies that offer regular payouts to shareholders.

- Real Estate Investments: Rental properties can yield steady monthly income and long-term appreciation.

- Peer-to-Peer Lending: Platforms that connect borrowers and lenders can generate interest without traditional bank involvement.

- Digital Products: Create and sell e-books, online courses, or software that continue to return money over time.

Additionally, diversifying your passive income sources can help mitigate risks and create a more robust financial future. Prioritize options that align with your skills and interests, as passion-driven projects can often yield better results. Consider the following factors when selecting your :

| Factor | Description |

|---|---|

| Initial Investment | Consider the upfront cash required to start. |

| Time Commitment | Assess how much time you’re willing to invest initially. |

| Return on Investment (ROI) | Evaluate potential earnings versus risks involved. |

Tax Planning

Being mindful of spending habits is crucial not only for maintaining personal finances but also for effective . By understanding how expenditures impact your tax liability, you can create a strategy that maximizes deductions while minimizing taxable income. Some practical approaches include:

- Documenting Expenses: Keep detailed records of all deductible expenses throughout the year.

- Timing Purchases: If possible, schedule major purchases for the end of the year to take advantage of tax deductions.

- Utilizing Tax-Advantaged Accounts: Contribute to accounts such as IRAs or HSAs to decrease your taxable income.

Additionally, understanding the potential tax implications of various spending categories helps you allocate your budget more effectively. By prioritizing tax-deductible expenses, you can derive both financial and tax benefits from your spending. For instance, consider this simple comparison of common deductible expenses:

| Expense Type | Deductible Status | Notes |

|---|---|---|

| Medical Expenses | Potentially deductible | Must exceed a certain percentage of AGI |

| Charitable Contributions | Fully deductible | Keep receipts for verification |

| Home Office | Potentially deductible | Requires exclusive use for business |

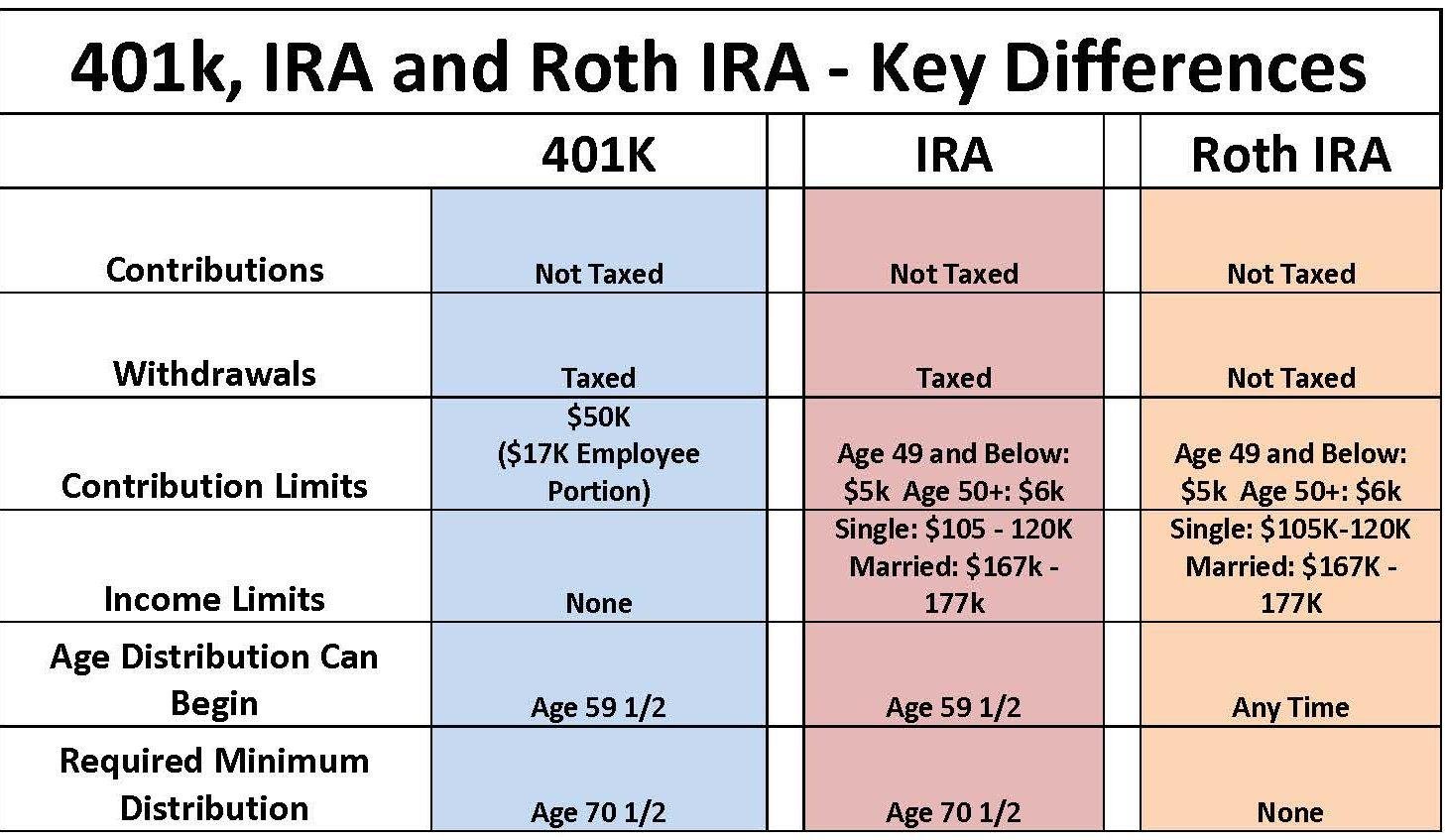

Retirement Accounts (IRA, 401k)

When considering your financial future, one of the most strategic moves you can make is to prioritize contributions to retirement accounts. These accounts offer unique tax advantages that not only boost your savings but can significantly alter your spending habits. For instance, a 401(k) plan often allows you to contribute a portion of your salary before taxes are deducted, effectively lowering your taxable income for the year. Additionally, many employers offer matching contributions, which can be seen as “free money” that propels your savings growth. As you build your retirement nest egg, it’s essential to view these contributions as a non-negotiable expenditure in your budget.

Similarly, an Individual Retirement Account (IRA) can serve as a powerful tool for smart spending. With options like the Traditional IRA or Roth IRA, you have the flexibility to choose the account that aligns best with your financial goals. For those who expect to be in a higher tax bracket during retirement, a Roth IRA’s tax-free withdrawals can be particularly appealing. It’s crucial to analyze how much you can safely allocate towards these contributions without compromising your current lifestyle. A well-structured plan can lead to sustainable spending habits that ensure both your present and future financial well-being.

Financial Planning for Families

Adopting smart spending habits is essential for families looking to secure their financial future. One of the most effective ways to start is by setting clear priorities for your expenses. Families can benefit from having a weekly or monthly budgeting meeting to discuss revenue and upcoming expenses. This fosters a sense of teamwork and accountability. Here are some key strategies to consider:

- Track Daily Spending: Keep a record of every expense to identify patterns and areas for improvement.

- Set Limits: Create spending limits for categories such as groceries, entertainment, and dining out.

- Utilize Coupons and Discounts: Make use of promotional offers to save on everyday purchases.

- Plan Meals: Planning meals can minimize food waste and encourage buying in bulk.

Implementing these spending practices allows families to enjoy their lifestyle while building financial security. It’s important to revisit and adjust your budget regularly. Establishing an emergency fund should also be a family priority. Start small—aim for a savings goal that can cover at least one month’s expenses. To give you a clearer framework, consider the following expense allocation table:

| Expense Category | Suggested Percentage |

|---|---|

| Housing | 30% |

| Utilities | 10% |

| Groceries | 15% |

| Transportation | 10% |

| Entertainment | 5% |

| Emergency Savings | 15% |

| Miscellaneous | 15% |

Personal Finance Apps

In the ever-evolving landscape of financial management, have emerged as indispensable tools for those looking to cultivate smart spending habits. These apps not only allow users to track their expenses in real-time but also provide insightful analytics on spending patterns, helping individuals understand where their money goes. With features such as budget creation, bill reminders, and spending alerts, users can establish a clearer picture of their financial health. Some popular options include:

- Mint – A comprehensive budgeting tool that tracks expenses and provides tips for savings.

- YNAB (You Need A Budget) – Focuses on proactive budgeting and encourages users to allocate every dollar to a job.

- Personal Capital – Offers investment tracking and financial planning tools alongside budgeting features.

To enhance your financial literacy, many of these apps include educational resources and community forums where users can share experiences and tips. Investing a little time setting up these can lead to significant rewards, such as improved savings and reduced debt. Below is a simple comparison table of essential features that help you make an informed choice:

| App Name | Key Feature | Cost |

|---|---|---|

| Mint | Automatic expense tracking | Free |

| YNAB | Proactive budgeting | $11.99/month |

| Personal Capital | Investment tracking | Free with premium services |

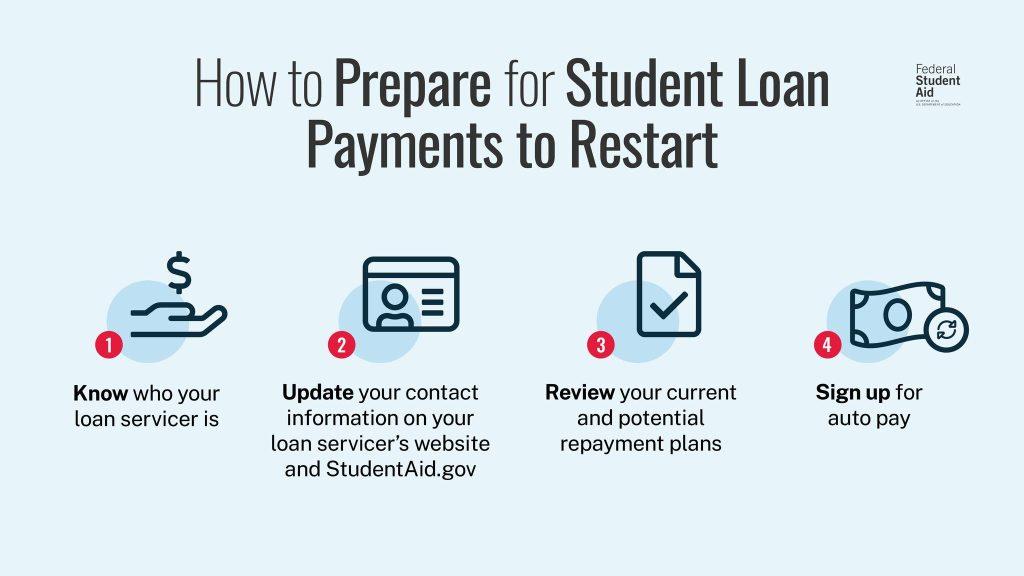

Student Loan Repayment

Managing s can feel overwhelming, but adopting smart spending habits can significantly ease this burden. Begin by categorizing your expenses into essential and non-essential. Focus on reducing non-essential expenses, such as takeout meals or impulsive shopping, and redirect those funds toward your loan payments. It might be helpful to track your spending for a month to identify areas where you can cut back. Consider implementing practices like meal prepping or using public transport to save money.

Additionally, setting a repayment schedule based on your budget can help you stay on track. Create a simple plan that includes:

- Minimum payment requirements: Ensure you never miss these to avoid penalties.

- Extra payments: Aim to pay a little more when possible; even a small amount can reduce interest over time.

- Emergency fund contributions: Allocate a portion of your budget for unexpected expenses to avoid reliance on credit cards.

By making small adjustments to your spending habits, you can free up resources for your student loans while also building a healthier financial future.

Debt-Free Journey

Adopting smart spending habits is crucial on the path to financial freedom. Start by setting clear priorities for your expenditures to distinguish between needs and wants. When crafting your budget, consider the following strategies:

- Track your daily expenses to identify unnecessary purchases.

- Create a monthly budget that aligns with your financial goals.

- Set aside a percentage of your income for savings.

- Utilize cash for discretionary spending to avoid overspending.

- Investigate upcoming sales or discounts for essential items.

Furthermore, establishing a mindful shopping practice can prevent impulsive decisions that lead to debt. Before making a purchase, ask yourself if it contributes to your long-term financial aspirations. Consider using a simple decision matrix to evaluate your purchases:

| Criteria | Yes | No |

|---|---|---|

| Does it support my budget? | ✔️ | ❌ |

| Will it provide long-term value? | ✔️ | ❌ |

| Is it a want more than a need? | ❌ | ✔️ |

Credit Card Management

Managing credit cards effectively is a cornerstone of smart financial habits. By understanding your spending patterns, you can maximize the benefits of any card you hold. Here are a few strategies to consider:

- Track Daily Expenses: Keeping a daily log helps identify unnecessary expenditures.

- Set Spending Limits: Establish monthly caps for different categories, such as dining or entertainment.

- Utilize Rewards Systems: Leverage cashback offers and points to enhance value from your purchases.

Moreover, being mindful of payment strategies can significantly improve your credit score and financial health. Implementing the following practices can lead to better outcomes:

| Tip | Benefit |

|---|---|

| Pay More Than Minimum | Reduces interest charges and debt levels. |

| Set Up Automatic Payments | Helps avoid late fees and keeps credit score healthy. |

| Review Statements Regularly | Detects unauthorized transactions and maintains budget. |

Budgeting for Freelancers

For freelancers, mastering the art of budgeting is crucial not just for financial stability but also for fostering smart spending habits. Begin by recognizing your income fluctuations; embrace the unpredictability that comes with freelancing by keeping a detailed account of your earnings. Create a monthly budget plan that includes all essential expenses such as:

- Housing: Rent, utilities, and internet

- Business Expenses: Software subscriptions, equipment, and dues

- Taxes: Set aside a percentage of your income

- Health Insurance: Monthly premiums and medical expenses

- Savings: Emergency fund and retirement contributions

Once you establish your budget, it’s important to distinguish between needs and wants. This conscious spending approach empowers you to avoid impulse purchases and prioritize your financial health. Consider implementing the 50/30/20 rule, where 50% of your income goes to necessities, 30% to non-essentials, and 20% to savings. Additionally, tracking expenses with tools or apps can offer insights into your spending habits. Below is a simplified example of a budget breakdown:

| Category | Percentage (%) | Amount ($) |

|---|---|---|

| Needs | 50 | 2500 |

| Wants | 30 | 1500 |

| Savings | 20 | 1000 |

Frugal Living Tips

Making smart financial choices is not about depriving yourself, but rather about re-evaluating your expenses and adjusting your lifestyle in a way that benefits your wallet. One effective approach is to set a weekly or monthly budget that prioritizes essential spending while minimizing indulgences. Use budgeting apps to track your expenses in real time, helping you stay on course. Additionally, consider automating savings; by directing a portion of your income into a savings account before you pay bills, you can make saving a natural part of your routine.

When shopping, embrace the art of comparison. Research prices online to ensure you’re getting the best deals, and don’t shy away from using coupons or joining loyalty programs. Another tip is to make use of thrift stores or online marketplaces for secondhand items, which can significantly cut costs. Remember, it’s the little changes in spending habits that can lead to substantial savings over time. Consider creating a table to track your spending patterns:

| Category | Monthly Budget | Actual Spending |

|---|---|---|

| Groceries | $300 | $270 |

| Utilities | $150 | $160 |

| Transportation | $200 | $180 |

| Entertainment | $100 | $50 |

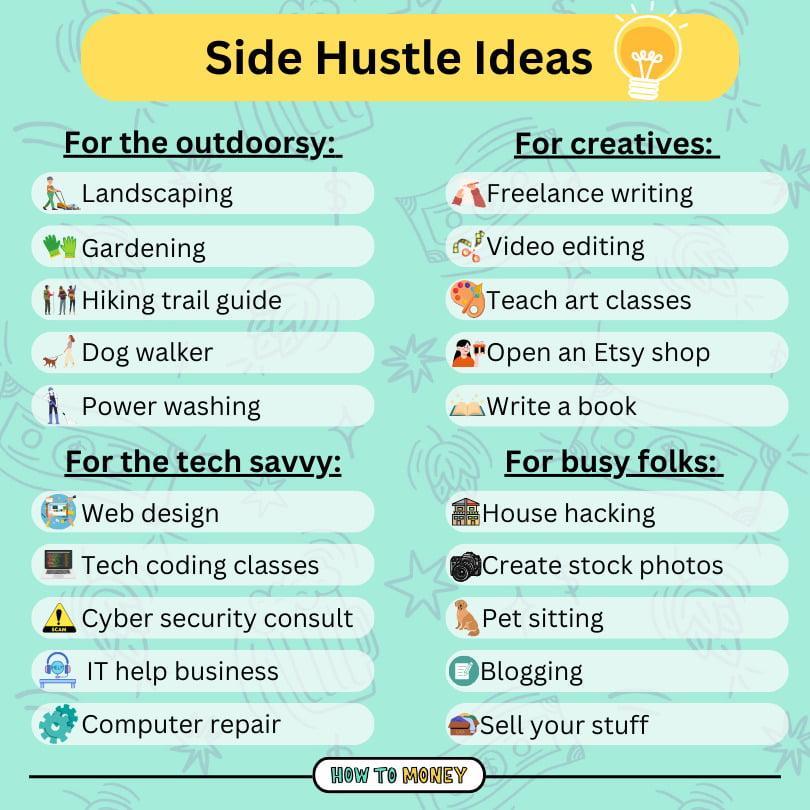

Side Hustles for Extra Income

Generating a secondary income can not only enhance your financial security but also allow you to explore your interests and passions. If you’re looking for effective avenues to generate income beyond your primary job, consider these options:

- Freelancing: Offer your skills, such as writing, graphic design, or programming, on platforms like Upwork or Fiverr.

- Online Tutoring: Share your expertise in a subject you love by teaching students through video calls.

- Sell Handmade Goods: Create unique items and sell them on Etsy or at local craft fairs.

- Pet Sitting or Dog Walking: Combine your love for animals with a side income through services like Rover.

- Affiliate Marketing: Promote products you believe in and earn a commission for every sale through your referral.

When exploring additional income streams, it’s helpful to track your potential earnings and the time you’ll invest. Below is a simple table to illustrate some common side hustles alongside estimated income and time commitment:

| Side Hustle | Estimated Monthly Income | Time Commitment (Hours/Week) |

|---|---|---|

| Freelancing | $500 – $3000 | 5 – 15 |

| Online Tutoring | $200 – $1500 | 3 – 10 |

| Sell Handmade Goods | $100 – $2000 | 5 – 20 |

| Pet Sitting | $300 – $1200 | 2 – 10 |

| Affiliate Marketing | $100 – $2000+ | 5 – 15 |

Financial Literacy Education

Developing sound spending habits is essential for long-term financial stability and growth. It involves making informed choices that align with one’s goals and values. To cultivate these habits, individuals should prioritize understanding their financial situation by tracking expenses and income. This practice not only provides insights into spending patterns but also highlights areas where savings can be maximized. Here are some effective strategies to adopt:

- Create a budget: Establish a clear, realistic budget that outlines monthly income and expenses.

- Differentiate needs and wants: Assess purchases critically to determine essential items versus discretionary spending.

- Practice mindful spending: Take time to consider the long-term value of each purchase to minimize impulse buys.

Incorporating these habits can lead to a significant transformation in financial health. Additionally, periodic evaluation of spending will reveal progress and areas in need of improvement. Consider maintaining a simple financial tracker, as shown below, to keep tabs on your monthly spending milestones:

| Category | Budgeted Amount | Actual Spending | Difference |

|---|---|---|---|

| Housing | $1,200 | $1,100 | $100 |

| Groceries | $300 | $350 | -$50 |

| Utilities | $200 | $180 | $20 |

| Entertainment | $150 | $200 | -$50 |

Insurance Planning

When it comes to smart spending, effective is an essential piece of the puzzle. It enables individuals and families to safeguard their finances against unexpected risks while also optimizing their budget. Start by evaluating your current insurance policies to determine what you truly need. Consider these key factors:

- Coverage Requirements: Assess your lifestyle and assets to ensure your policies adequately cover your needs.

- Cost-Benefit Analysis: Review the premiums versus the potential payout to find the best value.

- Discount Opportunities: Look for bundling discounts or loyalty programs that could lower your costs.

Additionally, investing time in understanding different insurance products can yield significant savings in the long run. Here’s a simple comparison of common insurance types to help in your decision-making:

| Insurance Type | Key Features | Average Premium |

|---|---|---|

| Health Insurance | Covers medical expenses and preventive care | $300/month |

| Auto Insurance | Protects against vehicle damage and liability | $150/month |

| Homeowners Insurance | Safeguards home and possessions | $100/month |

Long-Term Wealth Building

Building wealth doesn’t just happen overnight; it requires a strategic approach that combines smart spending habits with long-term planning. By focusing on deliberate consumption, individuals can allocate their resources more effectively, ensuring that every dollar spent contributes to their overall financial goals. It’s essential to evaluate your spending by asking critical questions: Is this purchase necessary? Will it appreciate in value? Incorporating these reflections into your daily decision-making can lead to significant savings over time.

Consider the following strategies to refine your spending:

- Create a budget: Establish clear limits for various categories, including necessities and discretionary items.

- Emphasize quality over quantity: Invest in durable goods that may cost more upfront but save money in the long run.

- Utilize cash-back and rewards programs: Take advantage of available perks while staying disciplined about spending.

- Automate savings: Set up automatic transfers to your savings account to prioritize your future financial health.

| Spending Category | Tip for Savings |

|---|---|

| Groceries | Plan meals weekly to prevent impulse buys. |

| Dining Out | Limit outings to special occasions or budget-friendly choices. |

| Subscriptions | Review monthly subscriptions and cancel the ones you rarely use. |

Saving for College

Building a robust savings plan for higher education starts with establishing smart spending habits in your daily life. By reassessing your financial priorities, you can carve out extra funds that can be directed toward a college savings account. Consider implementing the following strategies:

- Track your expenses monthly to identify unnecessary costs.

- Create a budget that focuses on savings for college first, allocating funds for essential spending afterward.

- Cut back on impulse purchases by establishing a 24-hour rule before buying non-essential items.

In addition to altering your spending patterns, you can leverage various tools to maximize your savings potential. Setting aside even small amounts can significantly accumulate over time. Here’s a snapshot of how consistent savings can grow:

| Monthly Savings | Total Saved in 5 Years | Total Saved in 10 Years |

|---|---|---|

| $50 | $3,000 | $6,000 |

| $100 | $6,000 | $12,000 |

| $200 | $12,000 | $24,000 |

By committing to these tactics, you can watch your college savings flourish, positioning your future student for a successful academic journey.

Estate Planning

Incorporating smart spending habits into your financial routine can significantly bolster your efforts. By establishing a clear budget and prioritizing your expenditures, you create a foundation that ensures not only your current financial stability but also the ability to leave a lasting legacy. Consider implementing the following strategies:

- Track your expenses: Keeping a detailed record of what you spend helps identify areas for potential savings.

- Establish an emergency fund: This provides financial security and protects against unforeseen expenses.

- Invest wisely: Allocate a portion of your income to investments that align with your long-term goals for wealth accumulation.

Additionally, it’s essential to regularly reassess your financial goals and make adjustments as necessary. Creating a dynamic estate plan is akin to crafting a living document that evolves alongside your financial situation. For clarity, here’s a simple comparison of different tools:

| Tool | Advantages | Disadvantages |

|---|---|---|

| Will | Simple to create; outlines asset distribution | May go through probate; can be contested |

| Trust | Avoids probate; offers privacy | More complex to set up; can be costly |

| Power of Attorney | Ensures decisions are made according to your wishes | Can be misused if not monitored |

Financial Goals Setting

Establishing clear financial aspirations is the cornerstone of any successful money management strategy. To effectively set these goals, it’s essential to prioritize your objectives, ensuring they align with your values and life ambitions. Consider breaking down your goals into short-term, medium-term, and long-term categories. This structured approach helps in creating actionable steps towards achieving each target:

- Short-term: Save for an emergency fund.

- Medium-term: Plan for a dream vacation.

- Long-term: Build a retirement nest egg.

Once your financial goals are clarified, developing smart spending habits becomes crucial. Examine your current spending patterns and identify areas where you can cut back without sacrificing quality of life. An effective strategy is to implement the 50/30/20 rule, which divides your income into three main spending categories. Here’s a simple breakdown:

| Category | Percentage | Example |

|---|---|---|

| Needs | 50% | Housing, utilities |

| Wants | 30% | Dining out, entertainment |

| Savings | 20% | Retirement, contingency fund |

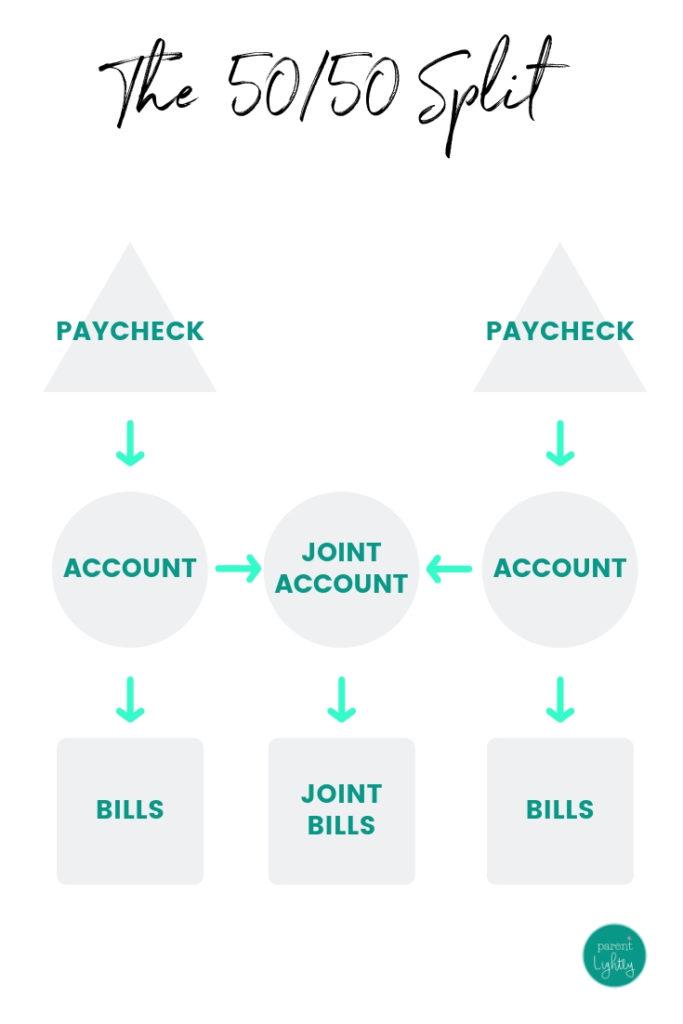

Money Management for Couples

Creating a solid framework for your financial partnership is essential. Start by establishing joint financial goals that align with both partners’ visions for the future. Here are some practical tips to cultivate smart spending habits:

- Create a joint budget that outlines both fixed and variable expenses.

- Divide responsibilities—one partner might handle bills, while the other manages savings.

- Set spending limits on discretionary expenses to ensure accountability.

To avoid conflicts and misunderstandings, regularly review your financial status together. Consider using tools or apps that facilitate transparent tracking of spending habits. You can also categorize expenditures to identify areas where you can cut back. Below is a simple table that illustrates common spending categories:

| Spending Category | Percentage of Budget |

|---|---|

| Housing | 30% |

| Food | 15% |

| Transportation | 10% |

| Entertainment | 10% |

| Savings | 20% |

| Miscellaneous | 15% |

Family Budgeting

Creating a sustainable household budget can transform your family’s financial landscape. By developing smart spending habits, you empower every family member to make informed decisions about money. Start by setting up a monthly budget that clearly outlines your income versus expenses. Consider categorizing your spending into distinct areas such as necessities, savings, and discretionary spending. This way, each dollar has a purpose, reducing the likelihood of impulse purchases and encouraging mindful expenditures.

Incorporating a few strategic practices can make your budgeting efforts more effective. For instance, use the 50/30/20 rule as a guideline to allocate your income: 50% for needs, 30% for wants, and 20% for savings. Additionally, track your spending using budgeting apps or a simple spreadsheet to maintain visibility into your financial habits. Here’s a concise table showcasing potential monthly expenses for better clarity:

| Category | Amount ($) |

|---|---|

| Housing | 1,200 |

| Grocery | 400 |

| Utilities | 200 |

| Transportation | 300 |

| Entertainment | 150 |

Smart Spending Habits

Building effective financial habits requires a thoughtful approach to spending that prioritizes long-term goals over immediate desires. By embracing mindful consumption, individuals can distinguish between needs and wants. Some strategies to consider include:

- Create a budget: Outline your monthly income and expenses to see where your money goes.

- Set spending limits: Allocate specific amounts for discretionary spending to maintain control.

- Use cash: Carrying cash can help curb impulse purchases and encourage mindful spending.

- Track spending: Regularly review your expenditures to identify patterns and areas for improvement.

Another essential component is to prioritize value over price, ensuring that purchases contribute to your overall well-being and financial health. Think about long-term investment in quality items rather than short-term satisfaction from cheaper alternatives. Evaluate your spending through the lens of potential returns using criteria such as:

| Criterion | Consideration |

|---|---|

| Durability | How long will the item last? |

| Utility | Will it serve a practical purpose in your life? |

| Emotional Fulfillment | Does it bring you joy or improve your quality of life? |

Personal Finance for Millennials

Mastering spending habits is vital for achieving financial stability. Millennials, often burdened with student debt and high living costs, can cultivate effective strategies to make their money stretch further. Prioritization is key; focusing on essential expenses and distinguishing them from wants can lead to smarter decisions. Consider implementing a 50/30/20 budget rule. Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This method not only promotes mindful spending but also ensures that you’re setting aside a portion for future investments or emergencies.

Another effective strategy is embracing intentional purchasing. Before making a significant purchase, ask yourself whether it aligns with your financial goals. Creating a spending list can prevent impulse buys while fostering a sense of accountability. Additionally, explore the potential of subscription services, which can sometimes provide cost-effective alternatives to traditional purchases. Take note of recurring expenditures such as streaming services or gym memberships; consider their value in relation to your budget. By adopting these habits, you can find a balance between enjoying life today and securing a stable financial future.

| Spending Area | Recommended % of Income |

|---|---|

| Needs | 50% |

| Wants | 30% |

| Savings/Debt Repayment | 20% |

Wealth Preservation Strategies

In an unpredictable financial landscape, cultivating desirable spending habits is essential for safeguarding your assets. A major aspect of smart financial management is understanding the difference between wants and needs. By prioritizing essential expenditures, individuals can liberate funds that can be redirected toward savings and investment. Consider implementing these practices:

- Create a monthly budget: Track your income and categorize your expenses.

- Limit impulse purchases: Avoid distractions that lead to spontaneous spending.

- Invest in quality over quantity: Choose durable products that provide long-term value.

Furthermore, the art of conscious spending can be bolstered by adopting a minimalist mindset. This involves evaluating every purchase and considering its impact on both your finances and your wellbeing. Engaging in this reflective practice can enhance your financial resilience and support wealth sustainability. Here’s a simple visualization to illustrate effective allocation of funds:

| Category | Percentage of Income |

|---|---|

| Essentials (e.g., housing, food) | 50% |

| Savings & Investments | 20% |

| Discretionary Spending | 30% |

In Conclusion

In a world filled with tempting distractions and ever-evolving consumer trends, cultivating smart spending habits is more crucial than ever. By consciously evaluating our choices, setting clear financial goals, and embracing the art of mindful purchasing, we can transform the way we interact with money. As you take the steps toward more intentional spending, remember that every small decision adds up to create a more secure and prosperous financial future. So whether you’re aiming to save for a dream vacation, build an emergency fund, or simply enjoy the peace of mind that comes with financial stability, the power to shape your economic landscape lies in your hands. Embrace these habits, and embark on a journey of empowerment that reflects your values and aspirations. After all, smart spending isn’t just a path to saving—it’s a pathway to living well.