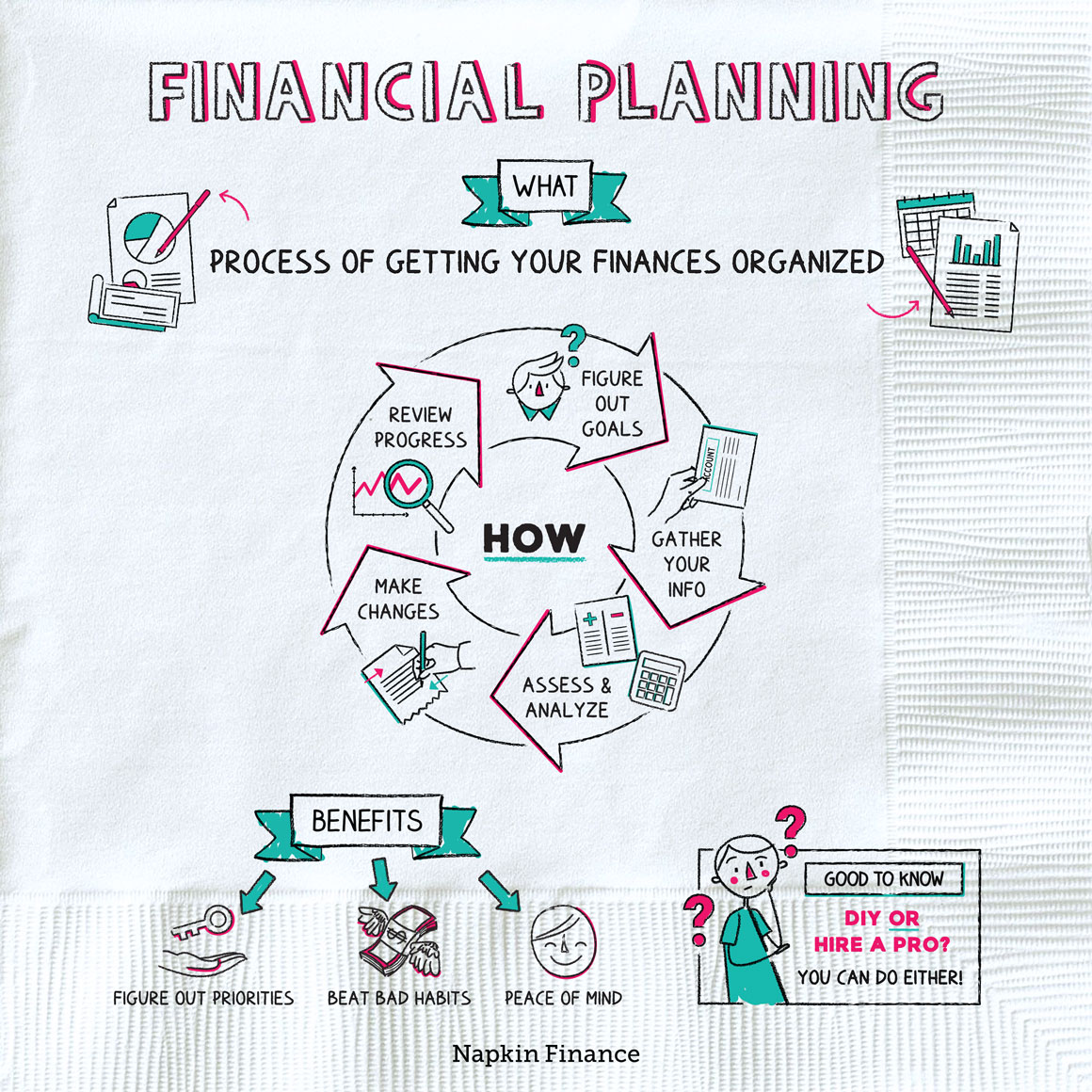

Title: The Safety Net: Navigating the Essentials of Emergency Fund Planning

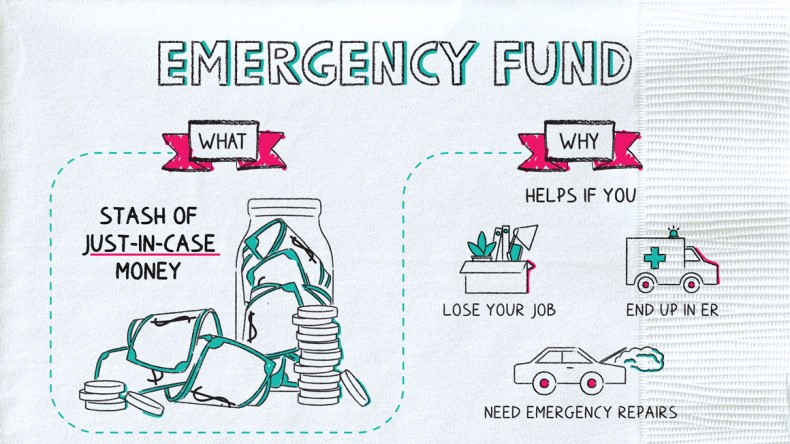

In a world where unpredictability reigns supreme, securing one’s financial future often hinges on preparedness. Just as a seasoned traveler relies on a sturdy map to navigate uncharted territory, individuals aiming for financial stability must equip themselves with a fundamental tool: the emergency fund. This financial cushion serves not only as protection from unforeseen expenses—such as medical emergencies, job loss, or urgent home repairs—but also as a peace of mind in an ever-changing landscape. In this article, we will delve into the essentials of emergency fund planning, exploring its significance, the optimal strategies for building your safety net, and the common pitfalls to avoid. Whether you’re just starting your financial journey or looking to reinforce your existing plans, understanding the nuances of emergency fund planning is a crucial step towards achieving resilience in the face of life’s inevitable surprises.

Budgeting Tips

Building a robust emergency fund is a key component of financial stability. It acts as your safety net during unexpected situations—be it medical expenses, car repairs, or job loss. To start, aim to save three to six months’ worth of living expenses. This may seem daunting, but breaking your goal into manageable milestones can make it more achievable. Complement your planning with these practical strategies:

- Set a Specific Goal: Determine the total amount you need and a timeline to reach it.

- Automate Savings: Set up automatic transfers to your separate emergency savings account each month.

- Cut Unnecessary Expenses: Review your current spending habits; find areas to trim back.

- Use Windfalls Wisely: Allocate bonuses, tax refunds, or other unexpected funds directly to your emergency reserve.

Tracking your progress can help keep you motivated. Consider using a simple table to visualize your savings journey. Displaying how each deposit brings you closer to your ultimate goal can be a powerful motivator.

| Month | Amount Saved | Current Total |

|---|---|---|

| January | $200 | $200 |

| February | $300 | $500 |

| March | $250 | $750 |

Debt Management

Managing debt effectively is crucial to ensuring financial stability, especially when unexpected expenses arise. An emergency fund can serve as a safety net that not only helps in mitigating the stress associated with sudden costs but also prevents you from falling deeper into debt. By setting aside a small percentage of your income, you can gradually build a reserve that allows you to handle emergencies without resorting to credit cards or high-interest loans. Consider the following strategies for effective emergency fund planning:

- Set a Target Amount: Aim to save at least three to six months’ worth of living expenses.

- Automate Your Savings: Schedule regular transfers from your checking account to your emergency fund.

- Use a High-Interest Savings Account: Maximize your money’s growth by keeping your fund in a high-yield account.

- Monitor and Adjust: Reassess your goal as your financial situation changes, adjusting your target fund as necessary.

A well-structured emergency fund can also contribute positively to your overall strategy. By establishing clear boundaries between your savings and discretionary spending, you create a safer financial space that curtails impulsive decisions. If an emergency arises and you need to dip into your fund, aim to replenish it as soon as possible. Utilizing a simple table format can offer a clear view of your progress toward building that fund:

| Month | Deposit Amount | Total Savings |

|---|---|---|

| January | $200 | $200 |

| February | $150 | $350 |

| March | $250 | $600 |

Saving for Retirement

Planning for retirement requires foresight and a keen understanding of your financial landscape. Establishing a robust emergency fund is a crucial step toward ensuring that your retirement savings remain untapped in times of unexpected need. This fund acts as your financial safety net, allowing you to cover unforeseen expenses without derailing your long-term savings goals. Here are a few key components to consider when building your emergency fund:

- Determine your target amount: Aim for three to six months’ worth of living expenses.

- Choose the right account: Opt for a high-yield savings account for easy access and decent interest rates.

- Regular contributions: Set up automatic transfers to ensure you consistently contribute to your emergency fund.

- Be adaptable: Reassess and adjust your goal as your income or expenses change over time.

Once your emergency fund is established, shift your focus to augmenting your retirement savings. This involves understanding the various investment options available to you, each with different risk levels and potential returns. Consider creating a simple comparison table to evaluate key aspects of several investment accounts:

| Account Type | Tax Advantages | Withdrawal Flexibility |

|---|---|---|

| 401(k) | Pre-tax contributions; grows tax-deferred | Penalties before age 59½ |

| Roth IRA | Post-tax contributions; grows tax-free | Withdrawals anytime; tax-free after age 59½ |

| Traditional IRA | Pre-tax contributions; grows tax-deferred | Penalties before age 59½ |

By actively managing your emergency fund alongside your retirement savings, you create a balanced approach to financial security. Making informed decisions now lays the groundwork for a stress-free retirement, allowing you to enjoy more of what life has to offer.

Emergency Fund Planning

When it comes to securing your financial future, establishing an emergency fund is a fundamental step that shouldn’t be overlooked. This fund acts as a financial safety net, ensuring that unexpected expenses—such as medical bills, car repairs, or job loss—don’t derail your financial stability. Here are some essential tips to consider while planning your emergency fund:

- Set a Goal: Aim to save 3 to 6 months’ worth of living expenses.

- Determine a Savings Rate: Decide how much you can comfortably save each month.

- Choose the Right Account: Look for a high-yield savings account or money market account for better returns.

Tracking your progress is vital to maintaining motivation and making adjustments to your strategy as necessary. Consider creating a simple budget that incorporates your emergency savings alongside your other financial obligations. You can use the table below to lay out your monthly savings plan:

| Month | Amount to Save | Total Saved |

|---|---|---|

| 1 | $200 | $200 |

| 2 | $200 | $400 |

| 3 | $200 | $600 |

Investment Strategies

When it comes to building a robust emergency fund, selecting the right is paramount. The goal is to create a safety net that allows you to cover unexpected expenses without jeopardizing your financial stability. Here are some effective methods to consider:

- High-Yield Savings Accounts: These accounts offer better interest rates than traditional savings accounts while maintaining liquidity, making them ideal for emergency funds.

- Certificates of Deposit (CDs): If you can lock away your savings for a short period, CDs can provide higher rates, though the funds are less accessible.

- Money Market Accounts: Combining aspects of both savings and checking accounts, they often yield higher returns and allow for limited withdrawals.

Consider diversifying your approach to ensure that your emergency fund remains both accessible and beneficial. It’s also prudent to regularly reassess your fund’s status and adjust your contributions as your financial situation evolves. Here’s a simple table to illustrate how different savings vehicles compare:

| Type | Interest Rate | Liquidity |

|---|---|---|

| High-Yield Savings | 1.5% – 2.0% | Immediate |

| CD | 2.0% – 2.5% | Locked for Term |

| Money Market | 1.0% – 1.5% | Limited Access |

Stock Market Investing

Building an emergency fund is a crucial step for anyone looking to navigate the unpredictable waters of . This financial cushion not only provides peace of mind but also ensures you are not forced to sell your investments during a downturn. To kickstart your emergency fund, consider allocating a specific percentage of your monthly income until you reach a target amount, typically covering three to six months of living expenses. This strategy allows investors to hold onto their stocks for longer, allowing them to recover from market fluctuations without the stress of immediate financial needs.

When it comes to determining how much you should set aside, consider the following factors:

- Monthly expenses: Calculate your necessary living costs.

- Job stability: Assess the security of your current employment situation.

- Financial obligations: Include any debts or responsibilities that require attention.

| Emergency Fund Guidelines | Recommended Savings |

|---|---|

| Single Individual | 3-6 months of expenses |

| Family of Four | 6-12 months of expenses |

| Self-Employed | 6-12 months of expenses |

Real Estate Investment

When diving into , it’s imperative to establish a solid emergency fund to safeguard your financial wellbeing. This fund acts as a safety net, ensuring that unexpected expenses won’t derail your investment journey. An effective emergency fund should encompass at least three to six months’ worth of living expenses, which can cover mortgage payments, maintenance costs, and other potential liabilities that may arise during your investment period. Consider assessing your financial habits and expenses to determine the right amount for your fund. Here are essential components to consider:

- Property Management Fees: Reserve for ongoing management costs.

- Unexpected Repairs: Set aside funds for sudden property repairs or renovations.

- Market Fluctuations: Allocate resources to withstand market volatility.

Furthermore, a well-planned emergency fund allows you to seize more investment opportunities without the stress of financial uncertainty. It enhances your ability to invest in additional properties or withstand vacancies without compromising your financial security. Regularly reviewing and adjusting your fund according to changes in your investments and financial status is crucial. Use the following table as a guideline for maintaining your emergency fund effectively:

| Fund Category | Recommended Amount | Purpose |

|---|---|---|

| Personal Living Expenses | $3,000 – $6,000 | Covers daily costs in case of emergencies |

| Investment Properties | $1,000 – $2,500 | Handles unexpected property expenses |

| Market Downturns | $2,000 – $5,000 | Stabilizes cash flow during low market periods |

Credit Score Improvement

Improving your credit score is a crucial step in securing a stable financial future, especially when planning for unexpected emergencies. A higher credit score not only opens doors to better loan terms and lower interest rates but can also provide peace of mind during uncertain times. To begin enhancing your score, consider implementing these practices:

- Pay Bills on Time: Consistent, timely payments are essential for a healthy credit history.

- Reduce Debt Utilization: Aim to keep your credit utilization under 30% of your available credit limits.

- Limit New Credit Applications: Each new application can slightly decrease your score; be strategic about when to apply.

- Regularly Check Your Credit Report: Take the time to identify any discrepancies or areas for improvement.

- Diversify Your Credit Types: A mix of credit (installment loans, revolving credit) can positively impact your score.

It’s important to maintain these practices regularly, as improvements to your credit score are often gradual. Consider tracking your progress through a simple table to monitor changes over time:

| Month | Credit Score | Actions Taken |

|---|---|---|

| January | 680 | Paid off credit card balance |

| February | 690 | Set up autopay for bills |

| March | 700 | Applied for a secured credit card |

Financial Independence

Establishing a robust emergency fund is a cornerstone of achieving financial freedom. It acts as a safety net, protecting you from unforeseen expenses such as medical emergencies, job loss, or urgent repairs. To build this fund, consider the three key components:

- Evaluate Your Expenses: Calculate your monthly living expenses to determine a target fund size.

- Set a Savings Goal: Aim for at least three to six months’ worth of expenses, ensuring you have a buffer during tough times.

- Automate Savings: Set up automatic transfers to your emergency fund, making it easier to reach your goal without the temptation to spend.

Once your emergency fund is established, regularly reassess its adequacy. As life changes — from a new job to a growing family — your financial landscape shifts, potentially altering your funding needs. Consider implementing a strategy to maintain and grow your emergency fund:

| Strategy | Description |

|---|---|

| Review Periodically | Check every six months to see if your fund aligns with your current expense levels. |

| Adjust Contributions | Increase your monthly contributions as your income grows. |

| Secure High-Interest Accounts | Store your emergency fund in a high-yield savings account to earn interest while you save. |

Passive Income Streams

Building a robust emergency fund is essential for anyone looking to secure their financial future. Yet, while setting aside savings is crucial, supplementing your fund with can enhance its growth and stability. Consider these avenues:

- High-Interest Savings Accounts: Use online banks that offer competitive rates to earn interest effortlessly.

- Dividend Stocks: Invest in companies with a history of paying dividends to receive regular income without active management.

- Real Estate Investments: If feasible, think about rental properties or real estate crowdfunding platforms where you can earn money passively.

- Peer-to-Peer Lending: Participate in lending platforms that allow you to earn interest on funds loaned to individuals or businesses.

- Affiliate Marketing: Create a blog or website where you can promote products and earn commissions through affiliate links.

Integrating these passive income opportunities into your financial strategy can significantly bolster your emergency fund. To depict their potential contribution, here’s a simple overview:

| Income Stream | Estimated Monthly Income |

|---|---|

| High-Interest Savings | $20 |

| Dividend Stocks | $50 |

| Rental Property | $150 |

| Peer-to-Peer Lending | $30 |

| Affiliate Marketing | $40 |

By diversifying your income sources, you can respond to unforeseen financial challenges more effectively while growing your safety net over time.

Tax Planning

When it comes to safeguarding your financial future, strategic is a crucial aspect that should not be overlooked. Building an emergency fund can provide you with a safety net that not only covers unexpected expenses but can also be optimized for tax efficiency. Start by determining how much you realistically need in your fund based on your monthly expenses and potential emergencies. Consider the following factors:

- Income stability: Evaluate the stability of your income to decide how much to save.

- Living expenses: Calculate 3-6 months’ worth of living costs to cover any unforeseen circumstances.

- Financial goals: Align your emergency fund with your broader financial objectives.

Once you’ve established your emergency fund goal, it’s essential to consider tax-advantaged accounts where you can set aside funds. While traditional savings accounts may offer limited interest, options such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) can provide tax benefits while doubling as a safety net for medical emergencies. Explore the following types of accounts:

| Account Type | Tax Benefit | Use Cases |

|---|---|---|

| Health Savings Account (HSA) | Contributions are tax-deductible | Medical emergencies and expenses |

| Flexible Spending Account (FSA) | Pre-tax contributions | Qualified medical expenses |

| Roth IRA for Emergency Funds | Tax-free withdrawals on contributions | Long-term savings with flexible access |

Retirement Accounts (IRA, 401k)

When planning for emergencies, it’s crucial to differentiate between short-term needs and long-term savings, especially when considering options such as IRAs or 401(k)s. While these retirement accounts are excellent for securing your financial future, tapping into them prematurely for emergencies can lead to penalties and increased tax burdens. Instead, prioritize establishing a dedicated emergency fund that is easily accessible without jeopardizing your retirement savings. Consider allocating funds into a high-yield savings account where they can earn interest while remaining liquid.

To effectively manage both your emergency reserves and retirement accounts, create a balanced approach that includes:

- Emergency Fund Goal: Aim for three to six months’ worth of living expenses.

- Contribution to Retirement Accounts: Max out employer-matched contributions in a 401(k) or consider an IRA for additional tax advantages.

- Regular Review: Periodically assess both your emergency fund and retirement savings to ensure you are on track toward your financial goals.

| Account Type | Access Period | Penalty for Early Withdrawal |

|---|---|---|

| 401(k) | Until Age 59½ | 10% + Income Tax |

| IRA | Until Age 59½ | 10% + Income Tax |

| Emergency Fund | Immediate | No Penalty |

Financial Planning for Families

Building an emergency fund is a fundamental pillar of sound . This fund acts as a safety net to cover unexpected expenses, helping families avoid going into debt during challenging times. Consider setting aside three to six months’ worth of living expenses in a separate account. To make this goal more manageable, you can break it down into smaller, achievable milestones. For instance, if your family needs $15,000 as a safety net, aim to save $1,250 per month for a year. Here are some strategies to boost your emergency savings:

- Automate your savings by setting up a direct deposit from your paycheck.

- Cut down on unnecessary subscriptions and redirect those funds.

- Use any unexpected windfalls—like bonuses or tax refunds—to bolster your fund.

Tracking your progress can also be motivating. Consider creating a simple table to visualize your savings milestones—this not only keeps you accountable but can also help establish a routine around saving:

| Month | Amount Saved | Total Fund |

|---|---|---|

| 1 | $1,250 | $1,250 |

| 2 | $1,250 | $2,500 |

| 3 | $1,250 | $3,750 |

| 4 | $1,250 | $5,000 |

| 5 | $1,250 | $6,250 |

| 6 | $1,250 | $7,500 |

Personal Finance Apps

In the pursuit of building a solid emergency fund, can serve as your best ally. These digital tools simplify the process of budgeting, saving, and tracking your financial goals. With features like automatic expense tracking and customizable savings plans, many apps make it easier than ever to fund your emergency reserves. Some popular options include:

- Mint: Offers budgeting tools and expense tracking.

- YNAB (You Need A Budget): Focuses on proactive budgeting and accountability.

- Qapital: Uses customizable rules to automate savings.

- Acorns: Rounds up your purchases to save and invest your spare change.

In selecting the right app for your needs, consider your personal finance habits and preferences. Assess whether you prefer a simple tracking solution or a more comprehensive budgeting tool. Here’s a quick comparison table to help you decide:

| App | Key Feature | Best For |

|---|---|---|

| Mint | Comprehensive overview of finances | Budget beginners |

| YNAB | Proactive budgeting | Those wanting to break the paycheck-to-paycheck cycle |

| Qapital | Automated saving rules | Goal-oriented savers |

| Acorns | Micro-investing | New investors |

Student Loan Repayment

Managing your finances while repaying student loans can feel overwhelming, but having an emergency fund can significantly ease that burden. An emergency fund acts as a safety net, allowing you to cover unexpected expenses without derailing your loan repayment strategy. By setting aside a specific amount each month, you can gradually build a fund that will help cover emergencies, ensuring that your regular loan payments remain on track.

To get started on your emergency fund, consider creating a budget that prioritizes savings alongside your monthly loan repayments. Here are some tips to help you kickstart this important financial cushion:

- Set a Target: Aim for 3 to 6 months’ worth of expenses.

- Automate Savings: Set up automatic transfers to your emergency fund account.

- Cut Unnecessary Expenses: Identify areas where you can save.

Additionally, monitoring your options, like income-driven plans or refinancing, can provide further relief and flexibility in your budgeting process. Below is a simple table showing potential monthly savings based on various emergency fund goals:

| Goal Amount | Monthly Contribution for 1 Year | Monthly Contribution for 2 Years |

|---|---|---|

| $1,000 | $83.33 | $41.67 |

| $3,000 | $250.00 | $125.00 |

| $5,000 | $416.67 | $208.33 |

Debt-Free Journey

Building an emergency fund is a cornerstone of financial stability and a crucial step in your journey toward being debt-free. This fund acts as your financial safety net, allowing you to handle unexpected expenses without falling back on credit cards or loans. To effectively establish this fund, consider the following steps:

- Set a Goal: Aim to save between three to six months’ worth of living expenses.

- Automate Savings: Set up automatic transfers to your savings account each payday.

- Start Small: If three months feels overwhelming, start with a smaller target and gradually increase it.

- Track Your Progress: Regularly check your savings and celebrate milestones along the way.

An effective way to visualize your progress is by creating a simple savings table. Below is an example to illustrate how much you can save over a few months:

| Month | Amount Saved |

|---|---|

| 1 | $200 |

| 2 | $300 |

| 3 | $400 |

| 4 | $500 |

| 5 | $600 |

By following a structured approach and maintaining a consistent saving habit, you’ll not only be prepared for life’s unpredictabilities but also take significant steps toward eliminating debt and fostering a more stable financial future.

Credit Card Management

Managing your credit cards effectively plays a crucial role in maintaining a healthy financial life, especially when you are planning for emergencies. One of the key strategies is to keep your credit utilization ratio low, ideally below 30% of your total credit limit. This not only enhances your credit score but also provides a safety net when unforeseen circumstances arise. To achieve this balance, consider the following practices:

- Make timely payments to avoid late fees and potential interest rate hikes.

- Set up alerts for payment due dates to stay organized.

- Utilize rewards wisely – Many cards offer cash back or points that can be redirected to your emergency fund.

- Keep track of annual fees and benefits to maximize your card’s value.

Additionally, it’s essential to have clear guidelines on when and how to use your credit cards during emergencies. Create a strategic plan that links your credit obligations with your emergency fund. Below is a simple framework to help you align these two aspects:

| Emergency Type | Credit Card Use | Emergency Fund Draw |

|---|---|---|

| Car Repairs | Use credit for immediate repairs | Pay off balance with savings |

| Medical Expenses | Use credit for urgent services | Withdraw from fund afterwards |

| Job Loss | Minimal use to manage necessary expenses | Rely heavily on emergency fund |

Budgeting for Freelancers

For freelancers, having a well-structured emergency fund is essential to weathering financial storms. Start by determining your baseline expenses, which typically include essentials like rent, utilities, groceries, and health insurance. Once you’ve identified these costs, aim to set aside at least three to six months’ worth of expenses to create a safety net that can support you during lean periods or unforeseen emergencies. This fund can provide peace of mind and help you focus on your work, knowing you are covered if income becomes irregular.

When building your emergency fund, consider allocating a specific percentage of your earnings each month. Here’s a simple framework to get you started:

| Action Plan | Percentage of Income |

|---|---|

| Emergency Fund Contribution | 10-20% |

| Living Expenses Savings | 50% |

| Reinvestment into Business | 30% |

By consistently following this strategy, you’ll be well on your way to establishing a robust emergency fund that allows you to navigate the unpredictable nature of freelancing with confidence.

Frugal Living Tips

Building an emergency fund is a crucial step towards achieving financial stability, especially when living frugally. Start small, perhaps by saving just a few dollars each week. Over time, these contributions will add up, and before you know it, you’ll have a safety net to rely on. To make the process easier, consider setting up an automatic transfer from your checking to your savings account. This way, you’ll be less tempted to spend that money on non-essentials. Track your progress regularly by reviewing your savings goals; this can motivate you to continue putting money away.

To further reinforce your commitment to saving, create a budgeting system that allows for flexibility while still prioritizing your emergency fund. Here’s a simple budget breakdown to help visualize your expenses:

| Category | Percentage of Income |

|---|---|

| Essential Expenses | 50% |

| Savings & Emergency Fund | 20% |

| Discretionary Spending | 30% |

Adopting this structure can help ensure that you’re continuously contributing to your emergency fund while still covering your essential needs. Remember, the goal is to reach at least three to six months’ worth of living expenses in your emergency fund, providing a solid financial cushion in unpredictable circumstances.

Side Hustles for Extra Income

In today’s unpredictable economic landscape, generating extra income can be both a buffer and a lifeline. Consider exploring opportunities that align with your skills and availability. For instance, freelancing in areas such as graphic design, writing, or web development can leverage your expertise, offering flexibility in hours and project scope. Additionally, online tutoring or teaching languages provides a rewarding way to share knowledge while supplementing your finances.

Another avenue to explore is selling handmade crafts or digital products on platforms like Etsy or Gumroad. If you possess a knack for crafts or digital design, this could turn your passion into profit. Furthermore, consider participating in the gig economy through services like ride-sharing or food delivery apps; these options enable you to earn on your terms. Below is a table outlining some popular side hustles and their potential income levels for easy reference:

| Side Hustle | Estimated Monthly Income |

|---|---|

| Freelance Writing | $500 – $2000 |

| Online Tutoring | $300 – $1000 |

| Craft Selling on Etsy | $200 – $1500 |

| Ride-Sharing (e.g. Uber) | $400 – $1500 |

Financial Literacy Education

Creating a robust emergency fund is essential for financial stability and peace of mind. An emergency fund acts as your safety net, helping you navigate unexpected expenses without resorting to debt. Here are some key components to consider when planning your fund:

- Determine Your Goal: Aim for three to six months’ worth of living expenses. This ensures you can cover essential costs, such as rent, utilities, and groceries, during unforeseen circumstances.

- Choose the Right Account: Opt for a high-yield savings account to keep your funds accessible while earning interest.

- Automate Contributions: Set up automatic transfers from your checking account to your emergency fund to build it consistently without much effort.

To better illustrate your financial planning, consider the following breakdown for monthly expenses:

| Expense Category | Average Monthly Amount |

|---|---|

| Housing | $1,200 |

| Utilities | $300 |

| Groceries | $400 |

| Transportation | $250 |

| Miscellaneous | $150 |

In this scenario, the total monthly expenses amount to $2,300. Thus, aiming for an emergency fund between $6,900 and $13,800 will provide a strong financial buffer. Remember, the goal is to create a sense of security that empowers you to face life’s uncertainties with confidence.

Insurance Planning

When considering financial security, one cannot overlook the significance of having the right insurance policies in place. In times of unexpected events or emergencies, well-structured insurance coverage will act as your safety net, helping to cushion the blow of unplanned expenses. It’s crucial to identify the types of insurance that best fit your lifestyle and needs. Here’s a succinct list of essential insurance types you might consider:

- Health Insurance – Safeguards you against high medical expenses.

- Disability Insurance – Provides income protection in case you’re unable to work.

- Life Insurance – Ensures your family’s financial stability upon your passing.

- Homeowners/Renters Insurance – Protects your property and belongings from unforeseen damage or loss.

- Auto Insurance – Covers car accidents and other vehicle-related incidents.

In parallel with aligning your insurance needs with your emergency fund planning, not all plans work uniformly. An effective strategy is to regularly review and adjust your coverage, ensuring it reflects your current financial situation and risk tolerance. Here’s a simple table to illustrate how different life stages might require varying levels of insurance coverage:

| Life Stage | Recommended Coverage |

|---|---|

| Single | Basic Health and Renter’s Insurance |

| Married with Children | Life, Health, and Homeowners Insurance |

| Empty Nester | Retirement and Long-term Care Insurance |

Long-Term Wealth Building

Building wealth over time requires a thoughtful approach to financial planning, and one of the essential first steps is establishing an emergency fund. This fund acts as a safety net, providing the necessary financial security to navigate life’s unexpected circumstances. By setting aside three to six months’ worth of expenses, you ensure that you can handle emergencies without derailing your long-term financial goals. Creating this buffer not only mitigates the need to dip into investments or accrue debt but also empowers you to make more strategic decisions about your wealth-building journey.

To effectively grow your emergency fund, consider employing a variety of savings strategies. You might use the following methods to gradually build your savings:

- Automating Savings: Set up automatic transfers to your emergency fund from each paycheck.

- High-Yield Savings Accounts: Open an account that offers higher interest rates to grow your fund faster.

- Utilizing Windfalls: Allocate bonuses, tax refunds, or any unexpected income directly to your emergency fund.

Here’s a simple breakdown to visualize your savings goals:

| Monthly Savings Goal | Time to Reach $5,000 |

|---|---|

| $100 | 50 months |

| $200 | 25 months |

| $300 | 17 months |

Establishing an emergency fund not only safeguards your financial future but also lays a strong foundation for wealth accumulation and growth. By prioritizing this essential savings strategy, you’re embarking on a path toward enhanced financial resilience and stability.

Saving for College

Planning for a child’s education can be one of the most significant financial commitments a parent faces. As tuition rates rise and the cost of living continues to fluctuate, it’s essential to start saving early. Setting up a dedicated savings account or utilizing college savings plans, such as 529 plans, can help parents focus their efforts and grow their funds efficiently. Consider these effective strategies to enhance your savings:

- Automatic Transfers: Set up automatic monthly transfers from your checking account to your savings account to ensure a consistent saving habit.

- Budget Reallocation: Review your monthly expenses and find areas to cut back. Redirecting these savings into your college fund can yield significant results over time.

- Research Scholarships: Stay informed about scholarship opportunities that may help minimize future education expenses.

To visualize how even small contributions can lead to substantial savings over the years, consider the following table:

| Monthly Contribution | Years Saving | Total Saved |

|---|---|---|

| $100 | 10 | $12,000 |

| $200 | 15 | $36,000 |

| $300 | 18 | $64,800 |

By making informed decisions, committing to regular savings, and leveraging various funding options, parents can effectively prepare for the financial demands of post-secondary education. Assessing the long-term impact of these strategies will ensure that your child can focus on their education, rather than worrying about student debt.

Estate Planning

Creating a robust emergency fund is essential to ensure that your estate remains intact and your loved ones are provided for in unforeseen circumstances. This financial cushion not only safeguards you against unexpected expenses but also plays a critical role in your overall strategy. Prioritizing the establishment and maintenance of an emergency fund allows you to meet immediate financial challenges without depleting other vital assets, ultimately protecting your long-term financial goals. Consider these key aspects for effective emergency fund planning:

- Determine Your Needs: Assess your monthly expenses to establish an adequate fund size.

- Automate Savings: Use automatic transfers to build your emergency fund consistently.

- Keep It Accessible: Your fund should be liquid enough for quick access in emergencies.

Moreover, to ensure your emergency fund aligns with your overall estate plan, it’s crucial to regularly review and adjust its size as your circumstances change. For example, significant life events like marriage, buying a home, or having children can shift your financial landscape dramatically. Keeping a close eye on your fund’s performance and adjusting accordingly can provide peace of mind, knowing that you have a solid financial buffer. Below is a simple framework to help you redefine your emergency fund structure:

| Life Event | Recommended Fund Size |

|---|---|

| Single Individual | 3-6 months of expenses |

| Couple with No Children | 6-9 months of expenses |

| Family with Children | 9-12 months of expenses |

Financial Goals Setting

Establishing realistic financial goals is essential for cultivating a healthy financial future. When planning for an emergency fund, aim to cover three to six months’ worth of living expenses. This provides a safety net during unexpected events, such as job loss or medical emergencies. To kickstart this process, it can be helpful to identify your monthly expenses and categorize them into essential and non-essential spending. Here’s a simple breakdown:

- Essentials: Rent, utilities, groceries, transportation, insurance

- Non-essentials: Dining out, entertainment, subscriptions, luxury items

Next, set a specific target amount that reflects your personal circumstances. For clarity, this can be represented in a simple table:

| Expense Category | Monthly Amount ($) | 3-Month Target ($) | 6-Month Target ($) |

|---|---|---|---|

| Essentials | 2,000 | 6,000 | 12,000 |

| Non-essentials | 500 | 1,500 | 3,000 |

This table offers a clear visual representation of how much you should aim to save for your emergency fund. As you progress towards your financial goals, regularly reassess your needs and adjust your targets accordingly, ensuring that your emergency fund remains robust and sufficient.

Money Management for Couples

Creating an emergency fund is a crucial step in ensuring financial stability for couples. This financial cushion should ideally cover three to six months of living expenses, allowing partners to navigate unexpected challenges such as job loss, medical emergencies, or major repairs without derailing their overall financial plan. To determine how much to save, a couple can start by calculating their essential monthly expenses, including rent or mortgage, utilities, groceries, and insurance. From there, they can set achievable savings milestones, ensuring they contribute consistently to their fund.

To make the process more manageable, couples can adopt the following strategies:

- Set a goal: Decide on a total emergency fund target together.

- Automatic savings: Set up automatic transfers to a dedicated savings account each month.

- Review regularly: Periodically assess the fund to ensure it meets current living expenses.

- Celebrate milestones: Acknowledge when you reach savings milestones to stay motivated.

| Expense Category | Estimated Monthly Cost |

|---|---|

| Rent/Mortgage | $1,500 |

| Utilities | $300 |

| Groceries | $400 |

| Insurance | $250 |

Family Budgeting

Building an emergency fund is a crucial step for every family to achieve financial stability. By setting aside a dedicated amount of savings, you create a safety net that can cover unexpected expenses that may arise, such as medical emergencies, car repairs, or home maintenance. To effectively kickstart your emergency fund, consider the following strategies:

- Assess Your Needs: Determine how much money you would need for at least three to six months of living expenses.

- Set a Monthly Goal: Decide on a realistic amount to save each month based on your current budget.

- Automate Your Savings: Set up an automatic transfer to your savings account, making it easier to reach your goal.

As your emergency fund grows, you’ll feel more confident in your financial situation. Tracking your progress is key, and you can keep your family engaged in this process. Create a simple table to visualize your savings milestones:

| Month | Amount Saved | Total Fund |

|---|---|---|

| January | $200 | $200 |

| February | $200 | $400 |

| March | $300 | $700 |

| April | $300 | $1000 |

This table can serve as a motivating tool for the entire family, demonstrating how even small contributions can build a significant safety net over time. Celebrate each milestone you reach to reinforce the importance of saving and being prepared for life’s surprises.

Smart Spending Habits

Building an emergency fund is a crucial component of achieving financial security. To cultivate that contribute to this fund, it’s essential to prioritize your savings and treat them as a non-negotiable expense. Consider implementing the 50/30/20 rule, which suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings. By adhering to this budget, you can ensure that you regularly set aside a portion of your income for unexpected expenses without compromising your quality of life.

Moreover, cultivating a habit of tracking your spending can uncover areas where you can tighten your budget. Implementing a few small changes can lead to significant savings over time. Here are some strategies to kickstart those :

- Review Subscriptions: Regularly check and cancel any unused services.

- Meal Planning: Preparing meals in advance cuts down on last-minute takeout.

- Set Spending Limits: Designate a specific amount for discretionary spending each month.

- Use Cash Envelopes: Allocate cash for different spending categories to avoid overspending.

Personal Finance for Millennials

Building an emergency fund is essential for creating a financial cushion that can protect you in times of unexpected expenses. As a millennial navigating the complexities of modern life, establishing this safety net is more important than ever. Start by determining a realistic goal for your emergency fund, typically ranging from three to six months’ worth of living expenses. Here are some key factors to consider when setting your target:

- Monthly Expenses: Calculate what you spend each month on essentials, such as housing, food, and transportation.

- Job Security: Assess the stability of your current job—if you have a more volatile income, aim for a larger fund.

- Health Expenses: Consider potential medical expenses that insurance might not fully cover.

Once you’ve set a target, devise a plan to achieve it. Automate your savings to make consistent contributions without the temptation to spend. You might consider setting up a dedicated savings account that earns interest, separate from your regular checking account to minimize the risk of dipping into your emergency funds. Below is a simple illustration of potential savings strategies:

| Monthly Contribution | Time to Reach $5,000 |

|---|---|

| $200 | 25 months |

| $300 | 17 months |

| $500 | 10 months |

Wealth Preservation Strategies

Building a robust emergency fund is one of the most essential components of effective wealth preservation. An emergency fund acts as a financial safety net, providing peace of mind in unpredictable situations. Establishing this fund involves setting aside three to six months’ worth of living expenses in a readily accessible account, such as a high-yield savings account. This ensures that you have liquid cash available in case of unforeseen circumstances, such as job loss, medical emergencies, or urgent home repairs. To streamline the process, consider the following steps:

- Assess Your Monthly Expenses: Calculate fixed and variable costs.

- Set a Realistic Savings Goal: Decide on a target amount based on your calculations.

- Choose the Right Account: Opt for an account with no monthly fees and a competitive interest rate.

- Automate Savings: Set up automatic transfers to build your fund consistently.

A well-planned emergency fund not only protects your wealth but also allows for optimal financial flexibility. Regularly reviewing and adjusting your fund ensures it continues to meet your needs as your lifestyle evolves. One useful technique is to create a simple table to track your progress and goals toward building your emergency fund:

| Month | Savings Goal | Amount Saved | Remaining Balance |

|---|---|---|---|

| January | $5,000 | $1,000 | $4,000 |

| February | $5,000 | $1,500 | $2,500 |

| March | $5,000 | $2,000 | $500 |

In Summary

In closing, while life’s unpredictability can often feel overwhelming, the creation of an emergency fund serves as a sturdy anchor amidst the storm. By setting aside a dedicated reserve for unforeseen circumstances, you not only empower yourself to navigate financial turbulence with confidence but also cultivate a sense of peace that allows you to focus on your aspirations. Remember, building an emergency fund doesn’t happen overnight; it’s a gradual process that requires patience and discipline. However, with each contribution, you are taking a crucial step towards financial security. So, take a moment to assess your current situation, strategize your savings, and commit to a plan. Your future self will undoubtedly thank you for the prudent choices you make today. After all, a well-prepared mind can weather any storm.