In the world of entrepreneurship, every successful venture begins with a vision and a dream, but behind the scenes lies a framework that often goes unnoticed—a legal structure. Just as architects rely on blueprints to ensure the integrity of their designs, startup founders must navigate the complex landscape of legal frameworks to build solid foundations for their businesses. “Blueprints for Success: Navigating Startup Legal Structures” explores the intricacies of selecting the right legal entity, from sole proprietorships to corporations, and sheds light on the crucial decisions that can impact not only the trajectory of a startup but also its very survival. With the right knowledge and guidance, aspiring entrepreneurs can ensure that their legal choices are as innovative and forward-thinking as their business ideas, setting the stage for success in an ever-evolving marketplace. Join us as we delve into essential insights and practical strategies for crafting a resilient legal blueprint that supports growth, mitigates risk, and paves the way for a sustainable future.

Understanding the Landscape of Startup Legal Structures

In the dynamic world of startups, choosing the right legal structure can significantly impact your operational efficiency and growth potential. Entrepreneurs often grapple with various options, each with its unique advantages and limitations. The most common structures include Sole Proprietorships, Partnerships, LLCs (Limited Liability Companies), and Corporations. Each structure not only influences tax obligations and personal liability but also affects investment opportunities and management flexibility. Understanding these nuances is critical, so consider the following factors before deciding:

- Liability Protection: How much personal risk are you willing to take?

- Tax Implications: Can you optimize your profits post-tax?

- Investment Needs: Will you seek outside investors soon?

- Management Structure: How will your business be managed?

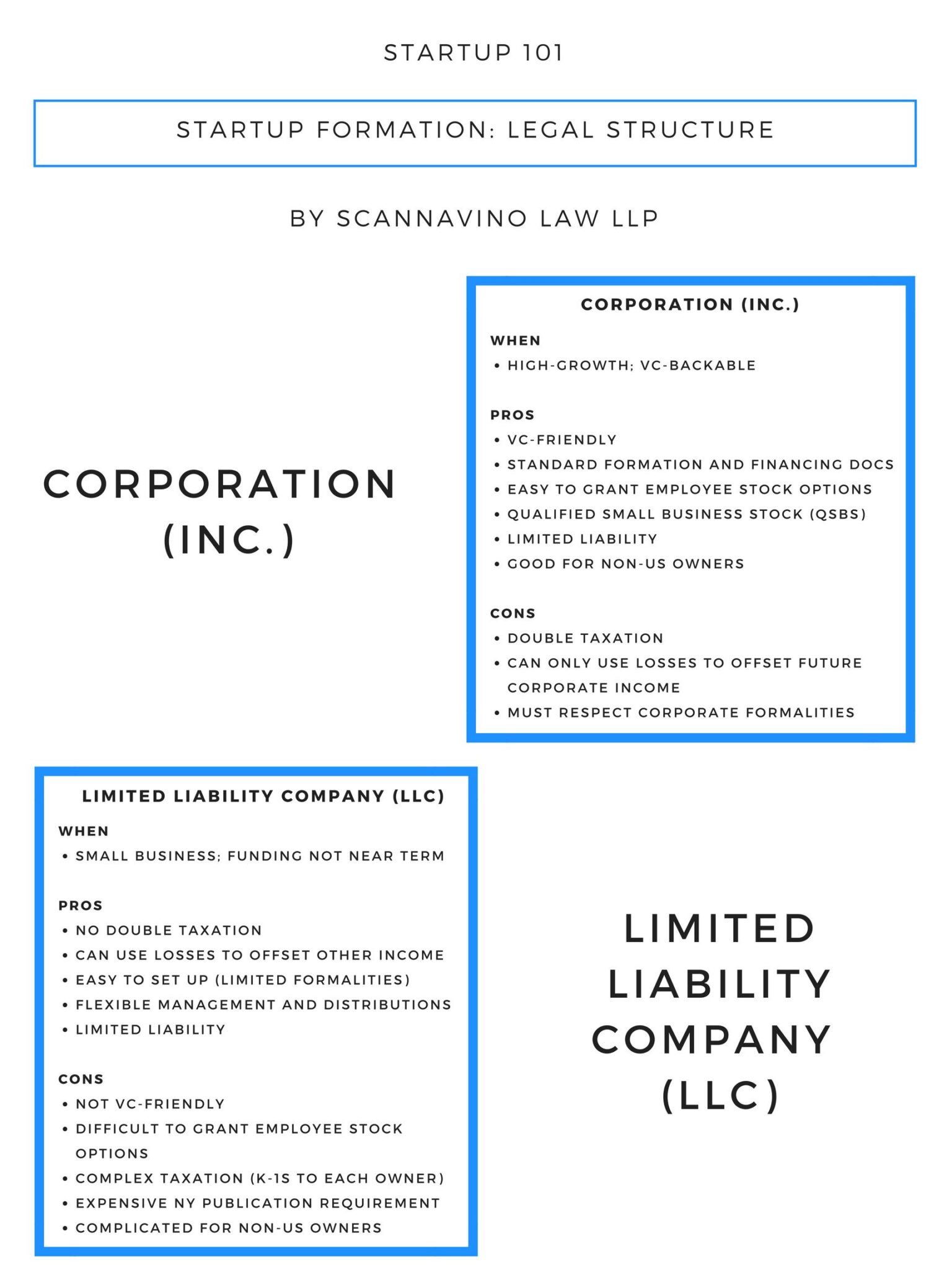

The implications of your legal structure extend beyond mere registration; they form the foundation for your business strategy. For example, startups seeking venture capital typically lean toward a C Corporation structure, as it allows for multiple classes of stock and potential for unlimited shareholders. In contrast, an LLC might be more appealing for founders prioritizing straightforward management and liability protection without the complexities of corporate governance. To visualize these differences, here’s a simple comparison:

| Structure | Liability Protection | Taxation | Ideal For |

|---|---|---|---|

| Sole Proprietorship | No | Personal Income Tax | Freelancers |

| Partnership | No | Pass-Through Taxation | Small Teams |

| LLC | Yes | Pass-Through Taxation or Corporate Tax | Small to Medium Businesses |

| Corporation | Yes | Corporate Tax | Growth-Focused Startups |

Choosing the Right Entity for Your Business Model

Selecting the appropriate legal structure for your venture is a crucial step that can significantly influence your business operations, tax obligations, and personal liability. These structures often include options such as Sole Proprietorship, Partnership, Limited Liability Company (LLC), and Corporation. Each entity has its unique characteristics that cater to different business needs. Understanding these distinctions can help you make a more informed decision:

- Sole Proprietorship: Easiest to set up and manage, but offers no protection against personal liability.

- Partnership: Ideal for businesses with multiple owners, but personal liability is shared among partners.

- LLC: Provides liability protection while allowing for flexible tax treatment.

- Corporation: Best for larger businesses or those seeking to raise capital, but involves more regulatory requirements.

Before making your choice, consider developing a brief comparison table to weigh the pros and cons of each entity against your specific business goals:

| Entity Type | Liability Protection | Tax Treatment | Complexity |

|---|---|---|---|

| Sole Proprietorship | No | Pass-Through | Low |

| Partnership | No | Pass-Through | Medium |

| LLC | Yes | Flexible | Medium |

| Corporation | Yes | Double Taxation | High |

Your final decision should align not only with current needs but also with your long-term vision. This foundational aspect of your business will shape various dimensions of your entrepreneurial journey, from funding to growth strategies. Take into account factors such as your industry, potential investors, and the liability you are willing to assume, as these will considerably impact your overall success.

Essential Compliance and Regulatory Considerations

Starting a business involves navigating a complex web of compliance and regulatory requirements that are crucial to its sustainability and success. Each legal structure, from sole proprietorships to corporations, comes with its own set of obligations. Key considerations include:

- Licensing and Permits: Determine the licenses required for your industry to operate legally.

- Tax Obligations: Understand the tax implications associated with your chosen legal structure, including income tax, payroll tax, and sales tax.

- Employment Laws: Ensure compliance with local, state, and federal employment regulations, including wage laws and safety standards.

Moreover, staying updated on the regulatory landscape is essential to avoid costly penalties. Consider integrating a compliance strategy that encompasses:

- Regular Audits: Schedule periodic reviews of your operations and legal adherence.

- Training Programs: Implement training for employees on compliance-related matters to foster an informed workplace culture.

- Consultation with Experts: Engage legal and financial advisors who can provide clarity on intricate rules affecting your startup.

| Compliance Area | Consideration |

|---|---|

| Tax Compliance | Filing deadlines and payment schedules |

| Environmental Regulations | Necessary impact assessments and permits |

| Data Protection | Adherence to privacy laws like GDPR or CCPA |

Building a Strong Foundation: Legal Documents Every Startup Needs

As a startup founder, it’s essential to ensure that you’re equipped with the right legal documents to set a strong foundation for your business. Without them, you risk crippling your venture over avoidable disputes or compliance issues. Among the key documents to have in place are:

- Operating Agreement: This outlines the structure of your company and the rights and responsibilities of its members.

- Non-Disclosure Agreement (NDA): Crucial for protecting your intellectual property and sensitive business information from being disclosed by employees or partners.

- Employment Agreements: Define the terms of employment, including duties, compensation, and termination clauses.

- Shareholder Agreement: This governs the relationship between shareholders, including how shares can be sold or transferred.

Moreover, your startup should not overlook the importance of registration and compliance documentation. Some essential papers include:

| Document | Purpose |

|---|---|

| Articles of Incorporation | Legal foundation of your corporation, establishing its existence. |

| Employer Identification Number (EIN) | Required for tax purposes and hiring employees. |

| State Business License | Permits operation in a specific state, ensuring compliance with local laws. |

Keeping these documents organized and up-to-date not only protects your startup but also helps instill confidence among investors, partners, and future employees. As your business grows and evolves, so too should your legal framework, adapting to new challenges and opportunities in the market.

Insights and Conclusions

As we navigate the complex terrain of startup legal structures, it becomes clear that the path to success is not just about innovative ideas and market strategies, but also about laying a sturdy legal foundation. The blueprints we’ve explored equip entrepreneurs with the understanding necessary to make informed decisions, ensuring that their ventures are not only visionary but also resilient against the myriad challenges that may arise.

Every startup journey is unique, and the choice of legal structure will depend on individual goals, risk tolerance, and growth aspirations. However, armed with the knowledge from this article, you are now better prepared to tailor your legal framework to fit the needs of your business, while safeguarding your interests and those of your stakeholders.

As you forge ahead into the world of entrepreneurship, remember that success is not merely defined by reaching the destination, but also by the thoughtful planning and strategic decisions made along the way. So, take these blueprints, adapt them to your vision, and build a successful startup that stands the test of time. Here’s to your journey, filled with innovation and legal clarity, as you transform your ideas into reality!